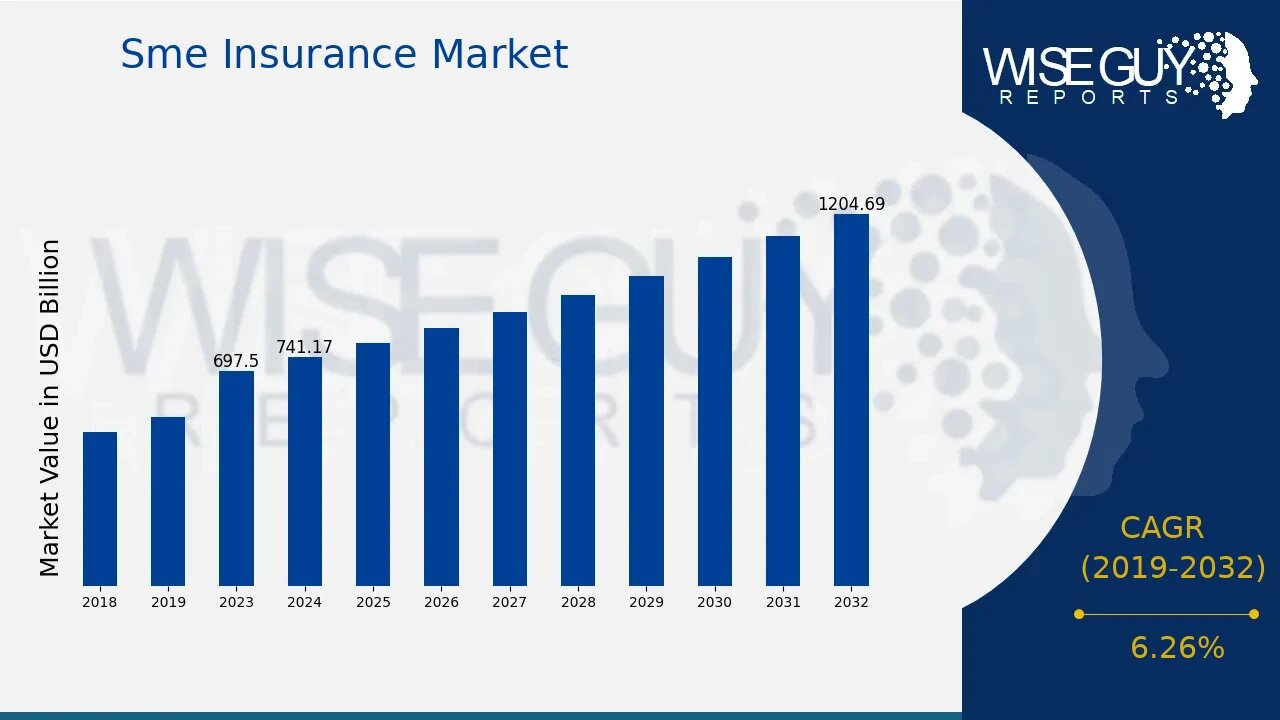

Sme Insurance Market Growth Set to Surge Significantly at a CAGR of 6.26% by 2032

Sme Insurance Market Research Report By Industry ,Company Size ,Revenue ,Insurance Type ,Distribution Channel ,Regional

VA, UNITED STATES, February 21, 2025 /EINPresswire.com/ -- The SME (Small and Medium Enterprises) Insurance Market is witnessing steady growth, driven by increasing awareness about business risks, regulatory requirements, and the rising need for financial protection among small and medium-sized enterprises. In 2023, the market size was estimated at USD 697.5 billion, with projections indicating growth from USD 741.17 billion in 2024 to USD 1205.35 billion by 2032, reflecting a compound annual growth rate (CAGR) of 6.26% during the forecast period (2024–2032). The expansion is fueled by the growing number of SMEs globally, digitalization in insurance services, and the increasing adoption of customized insurance policies.Key Drivers of Market Growth

Increasing Business Risks and Uncertainties

SMEs face a wide range of operational, financial, and cyber risks, making insurance essential for business continuity. With the rise in cyber threats, natural disasters, and liability claims, SMEs are increasingly investing in insurance coverage to mitigate potential losses.

Rising Government Regulations and Compliance Requirements

Many governments are mandating business insurance policies such as workers' compensation, liability coverage, and health insurance for employees. These regulations are driving SME insurance adoption across various sectors.

Growing Number of SMEs and Startups

With the global rise in entrepreneurship and small business formations, the demand for tailored insurance solutions is increasing. SMEs require policies that cover business interruption, asset protection, and liability risks, fueling market growth.

Digitalization and InsurTech Innovations

The integration of AI, blockchain, and data analytics in the insurance industry is simplifying the process of policy purchasing, claims processing, and risk assessment. InsurTech startups are offering digital platforms that enable SMEs to compare policies and get instant coverage, enhancing market penetration.

Affordability and Customization of Insurance Plans

Insurance providers are developing cost-effective, flexible policies that cater to the unique needs of SMEs. Customizable insurance plans covering cyber risks, business property, employee benefits, and liability protection are gaining traction among small businesses.

Download Sample Pages - https://www.wiseguyreports.com/sample-request?id=542790

Key Companies in the SME Insurance Market Include:

• Allianz

• AXA

• Zurich

• Chubb

• Hiscox

• AIG

• Liberty Mutual

• Travelers

• The Hartford

• Nationwide

• Progressive

• State Farm

• MetLife

• Farmers

• USAA

Browse In-depth Market Research Report: https://www.wiseguyreports.com/reports/sme-insurance-market

Market Segmentation

To provide a comprehensive analysis, the SME Insurance Market is segmented based on insurance type, coverage, distribution channel, and region.

1. By Insurance Type

• Property & Casualty Insurance: Covers physical assets such as buildings, inventory, and equipment.

• Liability Insurance: Protection against third-party claims, including general and professional liability.

• Workers' Compensation Insurance: Coverage for workplace injuries and employee benefits.

• Cyber Insurance: Policies covering data breaches, ransomware attacks, and IT infrastructure damage.

• Business Interruption Insurance: Compensation for lost revenue due to unexpected disruptions.

2. By Coverage

• Comprehensive Policies: Bundled insurance solutions covering multiple risks.

• Standalone Policies: Specific coverage options tailored to individual business needs.

3. By Distribution Channel

• Direct Insurance Providers: Companies offering policies directly to SMEs.

• Insurance Brokers & Agents: Third-party advisors assisting businesses in selecting the right coverage.

• Digital Platforms & InsurTech Startups: Online portals simplifying insurance comparison and purchase.

4. By Region

• North America: A leading market due to high SME penetration and strong regulatory frameworks.

• Europe: Growth driven by increased awareness and adoption of cyber insurance and liability coverage.

• Asia-Pacific: Rapid expansion due to the booming startup ecosystem in China, India, and Southeast Asia.

• Rest of the World (RoW): Emerging demand in Latin America, the Middle East, and Africa, with growing SME investments.

Procure Complete Research Report Now: https://www.wiseguyreports.com/checkout?currency=one_user-USD&report_id=542790

The Global SME Insurance Market is poised for steady growth as small and medium-sized businesses recognize the need for financial protection against evolving risks. The rise of InsurTech solutions, customized insurance plans, and regulatory mandates will continue to drive market expansion, making insurance a crucial component of SME sustainability and growth.

Related Report –

Back Office Outsourcing in Financial Services Market

https://www.wiseguyreports.com/reports/back-office-outsourcing-in-financial-services-market

Title Insurance Services Market

https://www.wiseguyreports.com/reports/title-insurance-services-market

Crypto Currency Market

https://www.wiseguyreports.com/reports/crypto-currency-market

it outsourcing in capital market

https://www.wiseguyreports.com/reports/it-outsourcing-in-capital-market

Virtual Data Room Software Market

https://www.wiseguyreports.com/reports/virtual-data-room-software-market

About Wise Guy Reports

𝖠𝗍 𝖶𝗂𝗌𝖾 𝖦𝗎𝗒 𝖱𝖾𝗉𝗈𝗋𝗍𝗌, accuracy, reliability, and timeliness are our main priorities when preparing our deliverables. We want our clients to have information that can be used to act upon their strategic initiatives. We, therefore, aim to be your trustworthy partner within dynamic business settings through excellence and innovation. We have a team of experts who blend industry knowledge and cutting-edge research methodologies to provide excellent insights across various sectors. Whether exploring new Market opportunities, appraising consumer behavior, or evaluating competitive landscapes, we offer bespoke research solutions for your specific objectives.

WiseGuyReports (WGR)

WISEGUY RESEARCH CONSULTANTS PVT LTD

+1 628-258-0070

email us here

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release