Ector County Saw A Fair Reassessment In 2024, Affecting Both Residential And Commercial Properties

O'Connor concluded that Ector County saw a fair reassessment in 2024, affecting both residential and commercial properties.

ODESSA, TEXAS, UNITED STATES, July 24, 2024 /EINPresswire.com/ -- Homes in Ector County Saw an Increase of 6%.

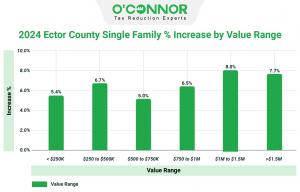

In Ector County, property values exhibited steady growth in 2024, with homes valued between $250K to $500K leading at 6.7%. Higher-valued properties priced between $1M and $1.5M saw an even higher increase of 8.0%, highlighting the market’s value increase from 2023.

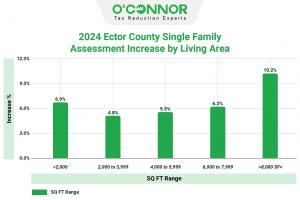

In Ector County, smaller residential properties under 2,000 square feet saw a market value increase of 6.9% from 2023 to 2024, while homes in the 6,000 to 7,999 square feet range rose by 6.2%. Notably, properties exceeding 8,000 square feet experienced the highest surge at 10.2%, indicating significant growth.

Odessa Metro Property Values on the Rise

In the aftermath of Ector County’s 2024 property tax reassessment, reports from the Ector County Appraisal District reveal a moderate surge of 6.0% in home values. However, in stark contrast, Odessa Metro witnessed a more substantial increase of 22.1% in actual home prices from January 2023 to January 2024, as per data sourced from previous sales records by the Odessa Metro Source.

Ector County Properties Undergo Diverse Increases in Value

In 2024, a comprehensive analysis of residential property values in Ector County revealed significant shifts. Notably, there was a noteworthy 13% increase in the value of residential homes classified as “others.” Intriguingly, tax records for this category lacked specifics regarding their construction years. Conversely, properties constructed between 1961 and 1980 saw the smallest rise in value, at just 3.1%. Overall, property values have been consistently on the rise, with an average annual growth rate of 6% across all construction years.

In 2024, the Ector County Appraisal District conducted a detailed examination of 208 residential accounts, comprising 59% of the total. Their findings revealed that the majority of these assessments were either accurate or slightly overestimated. However, 143 accounts, representing 41% of the total, were identified as overvalued. This study seeks to investigate the precision of property assessments by comparing the 2023 sales prices to the 2024 property tax reassessment values of residential properties.

Hotel Property Owners In Ector County Seen High Increases In Their Tax Revaluations.

In Ector County, the hotel real estate market skyrocketed, jumping an impressive 43% from $157 million to over $224 million compared to last year. Apartment owners also saw a significant uptick with a hefty 25% increase in their market values since 2023. Meanwhile, landowners experienced more modest growth, with values nudging up just 4% in the 2024 reassessment.

When analyzing commercial properties in Ector County based on their construction years, buildings erected between 1981 and 2000 saw a notable 15.5% increase in value, leading the pack. Properties built during the 1961 to 1980 period also experienced a significant rise of 15%. In contrast, properties categorized under ‘others,’ lacking recorded construction years in tax accounts, showed the smallest increase at approximately 4%. This data not only highlights the varied growth rates across different construction eras but also underscores the impact of detailed property record-keeping on accurate assessments.

Ector County Appraisal District’s 2024 Property Value Estimations Contrast Wall Street Analysts

The contrast between Green Street Real Estate company’s research and the 2024 commercial property tax reassessment by the Ector County Appraisal District is striking. The district’s assessment shows a 12.3% increase in commercial property values compared to the previous year, whereas Green Street reported a significant decline of 21%.

Ector County Property Taxable Value Increases by Value Range

In Ector County’s 2024 tax assessments, commercial property values have surged across diverse categories and price ranges. Properties valued between $1 million and $5 million saw a robust 15% uptick from their 2023 market value, highlighting strong market momentum. Conversely, properties priced below $500,000 showed the least growth, with a $20 million increase from their 2023 value, marking a steady 4% rise amidst dynamic market conditions.

Apartments in Ector County Built Between 1961 to 1980 Experienced Significant Property Growth

2024 brought significant changes to Ector County’s apartment complexes. Overall property tax assessments surged by 25.4%. Remarkably, apartments built between 1961 and 1980 led the charge with their value skyrocketing from $204 million to $278 million, a staggering 36% increase. Meanwhile, older apartment buildings, predating 1960, saw more modest growth, nudging up from $14 million to $15 million, marking a 5.5% rise. These trends illustrate a dynamic real estate market where newer developments drive substantial appreciation while older properties maintain steady value.

Fluctuations in Ector County Office Building Assessments by Construction Era

2024 has shown a notable 5% increase in property tax assessments across various year-built ranges, according to Ector County Appraisal District. Interestingly, office buildings categorized under ‘others,’ lacking specified construction years, experienced a significant decline of 38.3% in their assessments for the year. On the other hand, office buildings constructed between 1981 and 2000 saw the highest increase at 7.5%. This data underscores the diverse trajectory of property assessments across different construction periods, reflecting the dynamic nature of the local real estate market.

Retail Property Assessments Surge by 19.3%

Retail structures built between 1961 and 1980 took the lead, experiencing a notable 19% increase in value, rising from $92 million in 2023 to $110 million in 2024. In contrast, retail properties constructed from 1981 to 2000 saw the smallest increase, with a decline of 0.2%.

In Ector County, warehouse owners faced a surprising 10% spike in property tax assessments from 2023 to 2024 based on their construction year. The most striking increase was seen in warehouses built after 2001, which surged by an impressive 13.6%, soaring from $186 million to an impressive $211 million in assessed value. This sharp rise reflects a dynamic shift in Ector’s County commercial warehouse sector, where newer properties are clearly gaining significant value.

2024 Reassessment of Office Buildings by Type in Ector County

In 2024, two types of office buildings in Ector County experienced varying increases in property tax assessments. Office buildings saw a notable rise of 5.2%, while medical office buildings saw a more modest increase of approximately 3.5%. Overall, the total assessment for the year climbed by 5%, increasing from $1.5 billion to $1.6 billion.

Apartments in Ector County by Type Skyrocketed in 2024

Tier 2 apartment buildings in Ector County stole the spotlight in 2024. Their market value surged by an impressive 49.4%, leaping from $37 million to a robust $55 million. Meanwhile, the other type “apartment” complex also saw substantial growth, increasing by 24.2% from $728 million to an impressive $904 million. It looks like both apartment buildings have had substantial growth in their market values.

2024 Ector County Retail Property Tax Revaluation by Sub-Type

In 2024, property tax evaluations for strip shopping centers in Ector County surged by a remarkable 19.5%. Among them, retail stores saw a 6.7% increase in market value compared to 2023. Single tenant retail properties in the county also experienced a modest uptick of 1.4%.

Ector County Appraisal District Reports 10% Surge in Warehouse Property Values

Ector County Appraisal District revealed a robust 10% rise in market values across three warehouse property categories in 2024. Leading the charge, office warehouse buildings saw an impressive surge of 21.4%, climbing from $4.6 million to $5.6 million. Following closely, mini warehouses showed a solid increase of 11%, while traditional warehouses also saw a respectable uptick of 9.5%. It’s clear that warehouses of all types are gaining value in Ector County!

2024 Property Tax Reassessment by Ector County Appraisal District

Residential and commercial property values in Ector County saw notable increases during the reassessment period, standing strong despite declining trends in the Odessa Metro area. The residential real estate sector, usually stable, faces a mixed landscape. While commercial property values showed promising growth, both sectors also experienced some declines. This fluctuation can be partly attributed to a significant rise in interest rates—from 1.71% in January 2022 to 4.05% in January 2024. Moreover, consistent revenue patterns and rising costs such as casualty insurance and operational expenses add to these challenges.

Dispute Your Property’s Assessed Value Each Year

In Texas, including Ector County, property owners are afforded a valuable opportunity to challenge their property’s assessed value. Whether it’s a residential or commercial property, owners have the right to present evidence during the appeal process if they believe their assessment is too high. It’s highly recommended that owners consider filing an appeal or seek assistance from a property tax consulting service, as many challenges result in favorable outcomes. With over fifty years of experience, O’Connor is widely respected for advocating for property owners’ rights. Moreover, O’Connor is committed to effectively reducing taxes for property owners at a reasonable cost, using their extensive resources to achieve positive results.

About O’Connor

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 900 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

Facebook

X

LinkedIn

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.