Global Sales of Preowned Single-Engine Helicopters are on a Positive Trajectory during the First Half of 2024

Aero Asset released the 2024 Half Year Heli Market Trends Single-Engine edition analyzing the worldwide, preowned single-engine helicopter market.

TORONTO, ONTARIO, CANADA, July 8, 2024 /EINPresswire.com/ -- Aero Asset, a leading global helicopter sales and market intelligence firm, has announced the release of its latest report, the 2024 Half Year Heli Market Trends Single-Engine edition. This report, backed by Aero Asset’s expertise and proprietary market insight, offers a comprehensive analysis of the worldwide, preowned single-engine helicopter market in the first half or first semester of 2024. The data shows that global sales have stabilized on a positive trend for the first time in three semesters.

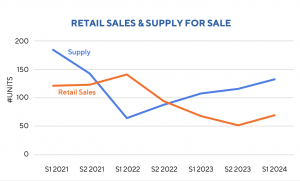

“During the first half of 2024, retail sales for single-engine helicopters were up for the first time in a year and a half,” said Valerie Pereira, Aero Asset’s Vice President of Market Research. “The supply of single-engines for sale also increased, but pricing remained steady versus the same timeframe last year.”

After falling for three consecutive semesters, Aero Asset’s market analysis shows that retail sales increased 4% in the first half of 2024 (S1 2024) compared to the same period in 2023 (YOY). The supply of single-engine helicopters ended 23% higher YOY, and the absorption rate increased to 13 months of supply at current trade levels.

Regions:

In the first half of 2024, Europe and North America accounted for 60% of the worldwide supply of single-engine helicopters for sale. Europe held the largest share of the supply (35%), followed by North America (25%), Asia Pacific (22%), Latin America (11%) and rest of world (7%).

The data reveals that retail transactions to Europe resumed in 2024 following a slump the previous year. However, most helicopter sales continue to be driven by North American buyers, accounting for 63% of all transactions S1 2024.

Liquidity:

The most liquid preowned single-engine helicopter market in the first half of 2024 was the Airbus AS350 B3/B3e/H125, followed by the Bell 407/GX/P/I and the Leonardo AW119K/Ke/Kx. The Airbus EC130 B4/H130 was the least liquid market, with an absorption rate of 1.6 years.

Download 2024 Half Year Heli Market Trends Single-Engine Edition:

Heli Market Trends reports have become a trusted source of insight and analysis covering the global preowned helicopter market. Visit aeroasset.com/report to download the latest report with all its data and valuable analysis. This report includes a conversation with Giacomo Zampetti, VP of Marketing at Leonardo Helicopters.

###

About Aero Asset Inc.

Aero Asset is an international helicopter trading and market intelligence firm, headquartered in Toronto, Canada. With a multicultural team and decades of experience marketing and selling aircraft across the globe, the company has grown into a world-leading helicopter sales and market intelligence firm.

Aero Asset is a member of the Helicopter Association International, the Association of Air Medical Services, the National Aircraft Finance Association, the European Helicopter Association, and the National Business Aviation Association.

For more information about the company, its inventory for sale, or its full scope of services and industry reports, please visit https://aeroasset.com.

Pierre Bled

Aero Asset

+1 732-578-8217

email us here

Visit us on social media:

LinkedIn

Instagram

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.