Litigation Funding Investment Market Size Reach USD 59.78 Billion by 2034 Growing with 9.62% CAGR

Litigation Funding Investment Market Growth

Litigation Funding Investment Market Research Report By, Type of Dispute, Stage of Funding, Funding Structure, Litigation Outcome, Regional

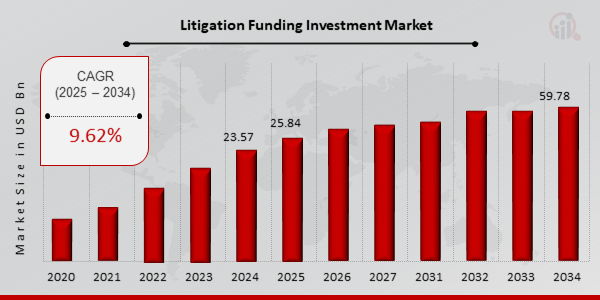

ME, UNITED STATES, February 20, 2025 /EINPresswire.com/ -- The global Litigation Funding Investment market has experienced significant growth in recent years and is set to expand further over the coming decade. In 2024, the market size was valued at USD 23.57 billion and is projected to grow from USD 25.84 billion in 2025 to an impressive USD 59.78 billion by 2034, reflecting a strong compound annual growth rate (CAGR) of 9.62% during the forecast period (2025–2034). The growth is primarily driven by increasing legal disputes, the rising acceptance of third-party litigation funding, and the growing interest of institutional investors in the litigation finance industry.

Key Drivers of Market Growth

Rising Legal Disputes and Litigation Costs

The increasing number of commercial, antitrust, intellectual property, and class action lawsuits has driven the demand for litigation funding. As legal expenses continue to rise, businesses and individuals are turning to third-party funders to finance costly legal battles, ensuring access to justice.

Growing Acceptance of Litigation Funding

Litigation funding has gained widespread acceptance, particularly in North America and Europe, as an essential tool for legal financing. Law firms and plaintiffs increasingly rely on external funding sources to manage legal costs, which is further driving market expansion.

Institutional Investor Participation

Hedge funds, private equity firms, and other institutional investors are recognizing litigation funding as an alternative asset class with high potential returns. The increasing capital inflows from these investors have expanded the market, providing more opportunities for litigation financing.

Regulatory Developments and Legal Frameworks

Several jurisdictions are developing regulations to provide transparency and governance in litigation funding. A clearer legal framework encourages more participants to enter the market and boosts investor confidence in litigation finance.

Technological Advancements in Legal Finance

The integration of artificial intelligence (AI), blockchain, and data analytics in legal financing has improved risk assessment, case selection, and investment strategies. These technological advancements are helping litigation funders optimize returns and mitigate risks.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/22886

Key Companies in the Litigation Funding Investment Market Include

• Woodsford Litigation Funding

• Fortress Investment Group

• Fairmount Funds Management

• Aquila Litigation Fund

• Omni Bridgeway

• Burford Capital

• Epiq

• Validity Finance

• IMF Bentham

• Pretium Law Funding

• Harbour Litigation Funding

• Donerail Group

• Echelon Capital Partners

• Rosewood Legal Finance

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/litigation-funding-investment-market-22886

Market Segmentation

To provide a comprehensive analysis, the Litigation Funding Investment market is segmented based on type, case type, investment type, and region.

1. By Type

• Commercial Litigation Funding: Involves financing corporate disputes, contract breaches, and business-related cases.

• Consumer Litigation Funding: Includes funding for personal injury claims, employment disputes, and other individual lawsuits.

2. By Case Type

• Antitrust and Competition Litigation: Driven by increasing regulatory scrutiny and corporate disputes.

• Intellectual Property Litigation: High-value patent infringement and trademark disputes fueling growth.

• Class Action Lawsuits: Growing consumer rights awareness leading to a rise in class-action cases.

• Bankruptcy and Insolvency Litigation: Businesses seeking financial recovery through legal means.

3. By Investment Type

• Single-Case Funding: Focuses on financing individual legal cases.

• Portfolio Funding: Provides funding for multiple cases under a single law firm or entity.

• Law Firm Financing: Law firms receive capital for litigation expenses and operational costs.

4. By Region

• North America: Largest market due to strong litigation culture and well-established funding firms.

• Europe: Expanding with increased regulatory clarity and institutional investor participation.

• Asia-Pacific: Rapid growth driven by increasing corporate disputes and evolving legal frameworks.

• Rest of the World (RoW): Emerging markets showing gradual adoption of litigation funding.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=22886

The global Litigation Funding Investment market is on a strong growth trajectory, driven by increasing litigation cases, regulatory developments, and technological advancements. As investors continue to explore opportunities in legal finance, the market is expected to witness significant transformations, providing enhanced access to justice and substantial returns for funders. With expanding opportunities across different litigation segments and regions, the future of the litigation funding industry looks promising.

Related Report –

Trade Finance Market

https://www.marketresearchfuture.com/reports/trade-finance-market-24698

Home Mortgage Finance Market

https://www.marketresearchfuture.com/reports/home-mortgage-finance-market-24607

Mortgage Loan Brokers Market

https://www.marketresearchfuture.com/reports/mortgage-loan-brokers-market-24638

Banking ERP Software Market

https://www.marketresearchfuture.com/reports/banking-erp-software-market-24836

Anti Money Laundering Solutions Market

https://www.marketresearchfuture.com/reports/anti-money-laundering-solutions-market-24771

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release