Generative AI in Capital Market Boost Finance Sector By USD 1,955 Million by 2033, CAGR of 24%

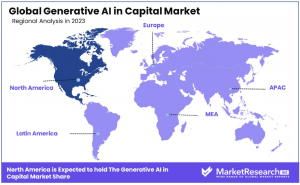

Regional Analysis: North America dominates with a 42% market share, while Europe follows closely, focusing on regulatory compliance and ethical AI integration.

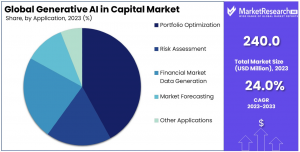

NEW YORK, NY, UNITED STATES, January 31, 2025 /EINPresswire.com/ -- The Generative AI in Capital Market is valued at USD 240 million as of 2023 and is projected to surge to USD 1,955 million by 2033, with a CAGR of 24%. This market leverages generative AI's innovative capabilities to transform financial strategies, providing data-driven solutions for portfolio optimization, risk assessment, and market forecasting.

The technology enables financial firms to enhance investment strategies and operational efficiencies by generating new data insights and predictive models. Generative AI is rapidly becoming integral to capital markets, fostering an era of increased automation and strategic advantage by supporting complex decision-making and customer engagement.

🔴 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://marketresearch.biz/report/generative-ai-in-capital-market/request-sample/

The growing adoption is driven by the need to capitalize on market shifts, optimize portfolios, and offer personalized financial products. As AI investments increase, the sector anticipates groundbreaking innovations that promise to reshape financial operations and investment strategies, aligning with evolving market demands for efficiency and precision.

Key Takeaways

Market Value Projection: The Global Generative AI in Capital Market is projected to reach around USD 1,955 Million by 2033, indicating a significant growth trajectory from USD 240 Million in 2023, with a CAGR of 24% during the forecast period from 2024 to 2033.

Dominant Segments:

Deployment Mode: On-premises solutions dominate, constituting 59% of the market, favored for enhanced security and control. However, cloud-based solutions, although smaller, offer scalability and cost-efficiency, appealing particularly to smaller firms and startups.

Application: Portfolio Optimization holds the majority share at 42%, followed by various other applications such as risk assessment, financial market data generation, and market forecasting.

End-User: Financial Institutions lead the market with 51% share, leveraging generative AI for various applications including customer service and compliance monitoring.

Regional Analysis: North America dominates with 42% market share, while Europe follows closely, focusing on regulatory compliance and ethical AI integration.

Key Players: IBM, NVIDIA Corporation, Goldman Sachs, JPMorgan Chase, BlackRock, Citadel, Bloomberg, DataRobot, and various other significant contributors to the market's growth and innovation.

Analyst Viewpoint: The rapid adoption of generative AI technologies by financial leaders signifies optimism regarding its potential to reshape the capital market landscape, offering increased efficiency, enhanced predictive capabilities, and the creation of novel financial instruments.

Growth Opportunities:

Democratizing Access to Insights: By democratizing access to advanced analytics and insights, generative AI expands the target market for AI vendors, fosters a competitive financial ecosystem, and stimulates innovation.

New Revenue Streams from Data Monetization: Generative AI enables firms to transform proprietary data into actionable insights, unlocking new revenue streams through data monetization, and encouraging a data-driven culture within organizations.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://marketresearch.biz/purchase-report/?report_id=39002

Experts Review

Experts highlight the profound impact generative AI has on capital markets, particularly in its ability to handle large datasets and automate complex financial analyses. While the technology offers robust opportunities for improved decision-making and strategic innovation, it also brings challenges like data privacy concerns and model transparency issues that must be addressed to maximize adoption.

Skepticism regarding AI-generated insights can limit integration, stressing the need for clear, understandable models. Furthermore, the industry's regulatory landscape necessitates careful navigation to ensure compliance and build trust in AI-driven outcomes. Focused efforts on enhancing model transparency and addressing security concerns are essential to easing apprehensions and promoting broader acceptance of AI technologies.

As generative AI continues to evolve, it presents significant potential for driving efficiency and creating competitive advantages in financial operations, provided these challenges are met with proactive strategies and robust safeguards.

🔴 𝐕𝐢𝐞𝐰 𝐏𝐃𝐅 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐒𝐚𝐦𝐩𝐥𝐞 @ https://marketresearch.biz/report/generative-ai-in-capital-market/request-sample/

Report Segmentation

The Generative AI in Capital Market is segmented by deployment mode, application, and end-user. Deployment modes include On-Premises, preferred by 59% for security and control, and Cloud-Based, favored for scalability and cost-effectiveness. Application segments focus on Portfolio Optimization (42% share), Risk Assessment, Financial Market Data Generation, and Market Forecasting, each utilizing AI to optimize various financial tasks.

End-users include Financial Institutions (dominant at 51%), Financial Analysts, Institutional Investors, and Other Stakeholders. These segments highlight the diverse applications and beneficiaries of AI advancements, showcasing the strategic advantage AI provides in processing complex financial data. Regional analysis places North America at the forefront with 42% market share, backed by technological innovation and robust financial sectors.

Europe and Asia-Pacific also demonstrate notable growth, driven by ongoing digital transformation and regulatory adaptations. Understanding these segments allows stakeholders to identify growth opportunities and tailor strategies for market penetration.

Key Market Segments

Based on Deployment Mode

On-Premises

Cloud-Based

Based on Application

Portfolio Optimization

Risk Assessment

Financial Market Data Generation

Market Forecasting

Other Applications

Based on End-User

Financial Institutions

Financial Analysts

Institutional Investors

Other End-Users

🔴 𝐆𝐞𝐭 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 (𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲) @ https://marketresearch.biz/purchase-report/?report_id=39002

Drivers, Restraints, Challenges, and Opportunities

The key drivers of growth in this market include the increased demand for sophisticated analytical capabilities and strategic insights that generative AI provides. The technology’s ability to enhance portfolio management and risk assessment makes it indispensable for modern financial operations.

However, significant restraints involve data privacy and security concerns, particularly due to the extensive data requirements of AI systems. The lack of transparency in AI-driven decision processes also poses challenges, deterring some firms from adopting these technologies fully. Opportunities are abundant as generative AI democratizes access to advanced financial tools, allowing smaller firms to compete with established players.

The growing availability of cloud-based AI solutions further enhances accessibility and affordability, encouraging broader market participation. Addressing privacy concerns and enhancing model explainability will be crucial to overcoming challenges and fully leveraging AI’s potential in capital markets to foster growth and innovation.

Key Player Analysis

Major contributors to the generative AI landscape in capital markets include technology giants like Amazon Web Services (AWS) and IBM Corporation, who leverage their advanced cloud capabilities and AI platforms to deliver dynamic solutions. AWS empowers financial institutions with scalable AI model deployments, while IBM’s Watson suite offers comprehensive analytical tools.

AlphaSense focuses on market intelligence, providing insights that drive decision-making in trading and investment. Birlasoft and EY (Ernst & Young) bring consulting expertise, integrating AI into existing workflows for enhanced efficiency and risk management.

Microsoft and Tata Consultancy Services Limited (TCS) are also pivotal, offering AI-driven enhancements in portfolio management and operational processes. These companies play vital roles in advancing AI capabilities, and supporting the integration and adoption of AI across the financial sector by offering tailored tools and strategic support.

Market Key Players

Alpha Sense

Amazon Web Services, Inc.

Birlasoft

EY (Ernst & Young)

IBM Corporation

Linedata

Microsoft

TATA Consultancy Services Limited

Recent Developments

Recent developments in the generative AI market focus on partnerships and innovations that enhance AI's role in capital markets. Notable is the collaboration between CalypsoAI and Deloitte Middle East, utilizing AI to advance security solutions in the region.

Morgan Stanley’s strategic shift towards generative AI, moving away from non-traditional ventures like electric vehicles, underscores the growing focus on AI to drive financial innovation. Research highlighting gaps in human rights due diligence indicates ongoing challenges in balancing technology advancement with ethical considerations.

These developments reflect the sector's commitment to leveraging AI for competitive advantage while navigating complex ethical and security landscapes. Continuous efforts by industry leaders to adapt and refine AI applications will be crucial in maintaining momentum and fostering sustainable growth.

Conclusion

The Generative AI in Capital Market is poised for substantial growth, driven by increased adoption and strategic integration of AI technologies. While the market offers significant benefits in enhanced financial analysis and decision-making, challenges such as data privacy and model transparency must be addressed.

The commitment of key players and ongoing innovations highlight AI's transformative potential, making it an essential tool in modern capital markets. Continued focus on ethical implementation and overcoming existing barriers will ensure that generative AI remains a pivotal force in shaping the future of financial operations and strategies.

➤ 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐎𝐭𝐡𝐞𝐫 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐓𝐨𝐩𝐢𝐜𝐬

In App Purchase Market - https://marketresearch.biz/report/in-app-purchase-market/

Generative AI in Construction Market - https://marketresearch.biz/report/generative-ai-in-construction-market/

Generative AI in Private Equity Market - https://marketresearch.biz/report/generative-ai-in-private-equity-market/

Televisions Market - https://marketresearch.biz/report/televisions-market/

Large Format Display (LFD) Market - https://marketresearch.biz/report/large-format-display-lfd-market/

Agricultural Drone Market - https://marketresearch.biz/report/agricultural-drone-market/

Privileged Access Management Solutions Market - https://marketresearch.biz/report/privileged-access-management-solutions-market/

Payment Processing Solution Market - https://marketresearch.biz/report/payment-processing-solution-market/

Fiber Optics Market - https://marketresearch.biz/report/fiber-optics-market/

Mobile Virtual Network Operator (MVNO) Market - https://marketresearch.biz/report/mobile-virtual-network-operator-mvno-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release