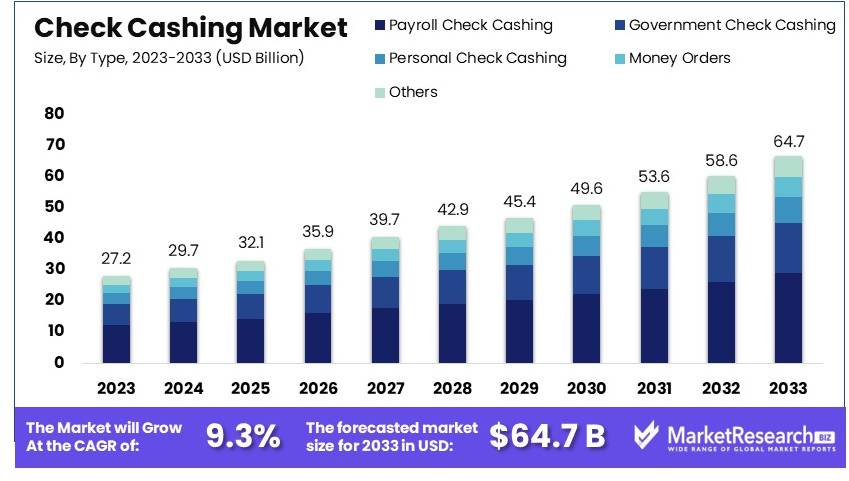

Check Cashing Market to Expand to USD 64.7 Billion by 2033, Individuals Hold Share at 78%

Check Cashing Market Size

The Check Cashing Market was valued at USD 29.7 B in 2024 and is projected to reach USD 64.7B by 2033, growing at a CAGR of 9.3%.

NEW YORK, USA, UNITED STATES, January 29, 2025 /EINPresswire.com/ -- Based on insights provided by Marketresearch.biz, The check cashing market consists of businesses that offer check cashing services to the public. These businesses cater primarily to individuals who are underbanked or unbanked, providing a crucial service for those who need immediate access to funds and do not have bank accounts. The market includes both small local operations and larger chains, each charging fees for their services based on the type of check being cashed and the amount involved.

Key factors driving the check cashing market include high levels of underbanked populations who lack access to traditional banking services. Many individuals rely on check cashing services due to their convenience, lack of eligibility for bank accounts, or the immediate need for cash which banks may not fulfill due to delays from check holds. Additionally, the simplicity and accessibility of check cashing services, often with locations offering extended hours and minimal requirements, contribute significantly to their popularity.

👉 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐆𝐫𝐨𝐰 𝐲𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://marketresearch.biz/purchase-report/?report_id=36471

Recent trends in the check cashing market include increased regulatory scrutiny to prevent financial fraud and money laundering. As a result, check cashing businesses are improving their transaction monitoring and verification processes. Moreover, there’s a growing trend of integrating technology such as mobile apps and online platforms, allowing customers to initiate check cashing transactions digitally, which adds convenience and enhances security.

The demand in the check cashing market remains strong among consumers who need quick access to cash and those who prefer not to deposit their money in banks. Economic factors, like wage levels and employment rates, also influence demand, as higher unemployment can lead to increased reliance on check cashing services among those receiving unemployment checks or other government aid.

For stakeholders, the check cashing market offers substantial revenue from service fees, which are profitable due to the high volume of transactions. Stakeholders also benefit from customer loyalty, as consistent users of check cashing services tend to return due to the necessity of these services. Furthermore, the market provides significant insights into consumer behavior for underbanked populations, which can guide future financial products and services targeting this group.

👉 𝐂𝐥𝐢𝐜𝐤 𝐭𝐨 𝐥𝐞𝐚𝐫𝐧, 𝐇𝐨𝐰 𝐝𝐚𝐭𝐚-𝐝𝐫𝐢𝐯𝐞𝐧 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐜𝐚𝐧 𝐢𝐦𝐩𝐚𝐜𝐭 𝐲𝐨𝐮𝐫 𝐦𝐚𝐫𝐤𝐞𝐭 𝐩𝐨𝐬𝐢𝐭𝐢𝐨𝐧, 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐀 𝐒𝐚𝐦𝐩𝐥𝐞 @ https://marketresearch.biz/report/check-cashing-market/request-sample/

Key Takeaways

➤ Market Size & Growth:

The check cashing market was valued at USD 27.2 billion in 2023 and is projected to reach USD 64.7 billion by 2033, expanding at a CAGR of 9.3% over the forecast period.

➤ By Type – Payroll Check Cashing Leads

Payroll check cashing holds the largest market share at 45%. This is because many workers rely on these services to access their wages without needing a bank account. The convenience and necessity of payroll check cashing make it the backbone of the industry.

➤ By End-User – Individuals Are the Core Consumers

Individuals dominate the market, accounting for 78% of total users. Many consumers lack access to traditional banking or prefer check cashing services for quick and easy transactions. This strong demand fuels the sector’s steady growth.

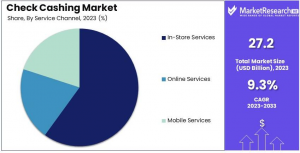

➤ By Service Channel – In-Store Services Drive the Market

In-store check cashing remains the most preferred option, with 60% market share. The need for immediate cash and personal interaction with service providers make physical locations essential. Many consumers prefer these services for their speed, security, and convenience.

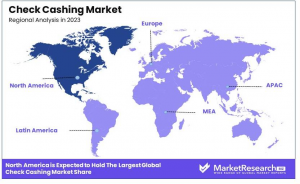

➤ Dominant Region – North America Leads the Industry

North America commands 45.8% of the global check cashing market. The region's well-established financial service infrastructure, widespread check usage, and large unbanked population contribute to its dominance.

👉 𝐆𝐞𝐭 𝐚 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐚𝐧𝐝 𝐏𝐫𝐨𝐟𝐞𝐬𝐬𝐢𝐨𝐧𝐚𝐥 𝐬𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅@ https://marketresearch.biz/report/check-cashing-market/request-sample/

Analysts’ Viewpoint regarding Check Cashing Market

Investment opportunities within this market are ample due to the increasing adoption of mobile technologies which provide greater convenience and expedited service to customers. Businesses are integrating mobile apps that allow for remote check approvals and instant access to funds, significantly enhancing the user experience and operational efficiency. However, the industry faces risks from regulatory changes, particularly around anti-money laundering (AML) and know-your-customer (KYC) regulations, which require robust compliance systems.

Consumer insights suggest a strong preference for immediate access to funds, driving the demand for in-store services, although online and mobile platforms are rapidly gaining traction. As of the latest data, in-store services dominate the market, holding a 60% share due to their ability to offer personalized experiences and immediate cash access. However, the growth of online and mobile services indicates a shift towards more digital solutions, reflecting broader consumer behavior trends towards convenience and speed.

Regional Analysis

North America's predominant position in the Check Cashing Market, holding a market share of 45.8%, is attributable to several key factors that underscore the region's robust financial services sector. This leadership is driven primarily by the high prevalence of check usage in business transactions, considerable investments in financial technology, and a significant unbanked population that relies on alternative financial services.

Firstly, the continued use of checks for business and personal transactions in North America, despite the global trend towards digital payments, supports the demand for check cashing services. Many businesses and individuals prefer checks for their reliability and the traceability they offer, which is essential for financial management and auditing purposes.

Additionally, North America is home to advanced financial technology ecosystems that enhance the services provided by the check cashing industry. Technological innovations, particularly in mobile and online platforms, have revolutionized how consumers access financial services. For example, mobile applications that enable remote check deposit and instant fund access are becoming increasingly prevalent, aligning with the consumer preference for quick and convenient financial transactions.

Moreover, a considerable portion of the North American population remains unbanked or underbanked. These individuals often rely on check cashing services as they may not have easy access to traditional banking. The services provided by the check cashing industry, therefore, play a crucial role in facilitating financial inclusion by offering an immediate solution for accessing funds without the need for a bank account.

𝐂𝐮𝐫𝐢𝐨𝐮𝐬 𝐚𝐛𝐨𝐮𝐭 𝐠𝐞𝐧𝐞𝐫𝐚𝐭𝐢𝐯𝐞 𝐀𝐈 𝐢𝐧 𝐦𝐚𝐫𝐤𝐞𝐭 𝐫𝐞𝐩𝐨𝐫𝐭𝐬? 𝐇𝐞𝐫𝐞’𝐬 𝐚 𝐧𝐞𝐰 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐧𝐚𝐥𝐲𝐳𝐢𝐧𝐠 𝐢𝐭𝐬 𝐢𝐦𝐩𝐚𝐜𝐭 𝐨𝐧 𝐭𝐡𝐞 𝐢𝐧𝐝𝐮𝐬𝐭𝐫𝐲.

Generative AI in Edtech Market - https://marketresearch.biz/report/generative-ai-in-edtech-market/

Global Generative AI in Supply Chain Market - https://marketresearch.biz/report/generative-ai-in-supply-chain-market/

Generative AI In Fashion Market - https://marketresearch.biz/report/generative-ai-in-fashion-market/

Generative AI In Agriculture Market - https://marketresearch.biz/report/generative-ai-in-agriculture-market/

Generative AI In Music Market - https://marketresearch.biz/report/generative-ai-in-music-market/

Report Segmentation

Type Analysis

Payroll check cashing stands out, accounting for approximately 45% of the market. This prominence is due to the consistent demand from workers who may not have access to traditional banking services. These individuals rely on check cashing services to access their earnings promptly.

End-User Analysis

Individuals are the primary users, making up about 78% of the market. The high demand for accessible financial services among unbanked and underbanked populations drives this trend. For many, check cashing services offer a practical solution to manage finances without the need for a traditional bank account.

Service Channel Analysis

In-store services lead the way, representing 60% of the market. The personalized experience and immediate access to cash make these services appealing. Customers value the face-to-face interactions and the ability to receive funds without delay.

👉 𝐃𝐫𝐢𝐯𝐞 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬 𝐆𝐫𝐨𝐰𝐭𝐡 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲: 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐟𝐨𝐫 𝐊𝐞𝐲 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 @ https://marketresearch.biz/purchase-report/?report_id=36471

Key Market Segments

By Type

Payroll Check Cashing

Government Check Cashing

Personal Check Cashing

Money Orders

Others

By End-User

Individuals

Small Businesses

By Service Channel

In-Store Services

Online Services

Mobile Services

Driver: Increasing Use of Business Checks

The check cashing services market is witnessing substantial growth driven by the increasing use of business checks. Despite the digitalization of financial transactions, business checks remain a staple in corporate financial operations due to their reliability and the detailed transaction records they provide. This traditional method of payment is preferred for its formality and security, making check cashing services indispensable for businesses needing immediate fund access.

The persistence of check usage in business transactions underscores the market's growth, as these services provide a quick and efficient way for companies to convert checks into liquid assets, enhancing cash flow management. This trend is evidenced by the rising volume of commercial checks processed annually, reflecting sustained demand in the check cashing sector.

Restraint: High Cost of Fees and Fraud Concerns

A significant restraint in the check cashing services market is the relatively high cost of transaction fees, which can deter potential users, particularly those seeking more economical financial solutions. These fees often represent a considerable portion of the transaction value, which can be particularly burdensome for low-income individuals who form a large part of the market's customer base.

Furthermore, the physical nature of checks and the processes involved in cashing them expose both service providers and customers to risks of forgery and counterfeiting. Fraudulent activities not only lead to direct financial losses but also undermine trust in the service, thereby potentially restricting market growth.

Opportunity: Enhanced Mobile Integration and Convenience

The integration of mobile technology presents a significant opportunity for the check cashing services market. With the advent of mobile applications, check cashing services can offer enhanced convenience by allowing users to deposit checks through their smartphones. This technology enables immediate fund access, a crucial advantage for users with urgent financial needs.

Mobile integration meets the growing consumer demand for quick and easy access to financial services, particularly among younger demographics who prefer digital solutions. By reducing the need for physical branch visits, mobile apps can expand market reach and accessibility, making financial services more inclusive.

Challenge: Continuous Regulatory Compliance

Check cashing services face the ongoing challenge of adhering to stringent regulatory requirements intended to prevent financial fraud and ensure consumer protection. Regulatory compliance involves significant operational oversight and the integration of advanced technological systems to manage risks effectively.

This requirement places a continuous burden on service providers to update their systems and practices in alignment with evolving laws and standards. The need for robust compliance measures can incur high costs and necessitate constant vigilance, posing a substantial challenge to maintaining profitability and operational efficiency in a highly regulated environment.

Market Key Players

ACE Cash Express, Inc.

The Check Cashing Store

PLS Financial Services, Inc.

Check Into Cash

Moneytree, Inc.

CFSC (Community Financial Service Centers)

Speedy Cash

Cash America International, Inc.

Western Union

MoneyGram International, Inc.

Pay-O-Matic

United Check Cashing

USA Checks Cashed

Friendly Check Cashing, Inc.

Cash Express, LLC

Conclusion

The check cashing market provides a critical financial service, particularly for the underbanked and unbanked populations, offering an immediate and accessible means to cash checks without a bank account. Despite its convenience and the essential services it provides, the sector faces significant challenges, including high fees and the potential financial vulnerability of its users. As the market evolves, it will likely see increased regulation and technological advancements aimed at enhancing service efficiency and security.

Stakeholders need to focus on addressing these challenges while maximizing the benefits to remain vital and profitable in the changing financial landscape. Continual adaptation and improvement will be key to sustaining the relevance and utility of check cashing services in a financial environment that increasingly favors digital and inclusive banking solutions.

Explore More Reports

Generative AI in Chatbots Market - https://marketresearch.biz/report/generative-ai-in-chatbots-market/

Generative AI in Utilities Market - https://marketresearch.biz/report/generative-ai-in-utilities-market/

Global Generative AI in Customer Services Market - https://marketresearch.biz/report/generative-ai-in-customer-services-market/

Generative AI In Real Estate Market Based - https://marketresearch.biz/report/generative-ai-in-real-estate/

Generative AI In Cyber Security Market - https://marketresearch.biz/report/generative-ai-in-cyber-security-market/

Global Generative AI in Software Development Market - https://marketresearch.biz/report/generative-ai-in-software-development-market/

Generative AI in Art Market - https://marketresearch.biz/report/generative-ai-in-art-market/

Global Generative AI in Education Market - https://marketresearch.biz/report/generative-ai-in-education-market/

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release