Pouches Market Estimated at USD 73.8 Billion in 2034, Growing at a CAGR of 5.0%

Pouches Market is expected to be worth around USD 73.8 Billion by 2034, up from USD 45.3 Billion in 2024, and grow at a CAGR of 5.0% from 2025 to 2034

NEW YORK, NY, UNITED STATES, January 28, 2025 /EINPresswire.com/ -- The global Pouches Market is experiencing significant growth and is projected to continue its upward trajectory over the next decade. With a current market size of USD 45.3 billion in 2024, the market is expected to reach approximately USD 73.8 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.0% from 2025 to 2034.

This growth can be attributed to rising demand for convenient, lightweight, and eco-friendly packaging solutions across various industries. Pouches are widely popular due to their versatility in packaging food, beverages, personal care, and pharmaceutical products.

The market is further boosted by consumer preference for sustainable and recyclable packaging options, driving innovations in materials such as biodegradable and recyclable pouches. Additionally, the growth of e-commerce and online retailing has created new opportunities for pouch packaging, enabling brands to offer secure and attractive packaging for direct-to-consumer sales.

Moreover, the expanding middle-class population in emerging markets and an increase in disposable income are further fueling the demand for pouches. With opportunities for market expansion, especially in Asia Pacific and Latin America, the pouches market is set to continue its positive growth trajectory, driven by evolving consumer preferences and innovations in packaging technology.

For a deeper understanding, click on the sample report link: https://market.us/report/pouches-market/free-sample/

Key Takeaways

• The Global Pouches Market is expected to be worth around USD 73.8 Billion by 2034, up from USD 45.3 Billion in 2024, and grow at a CAGR of 5.0% from 2025 to 2034.

• Stand-up pouches dominate the pouches market, holding a strong 58.2% share.

• Plastic remains the preferred material in the market, capturing a 62.1% share.

• Standard treatment type leads the market segment, accounting for 43.2% globally.

• Food and beverage applications hold the largest share at 69.2% overall.

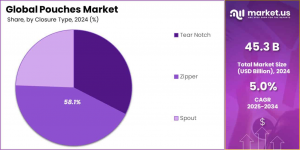

• Zipper closures are the most popular, securing a 58.1% market share.

• Pouches weighing 20-50 grams contribute significantly, covering 39.2% of demand.

• Direct heat sealers dominate sealing technology, commanding a 64.1% market share.

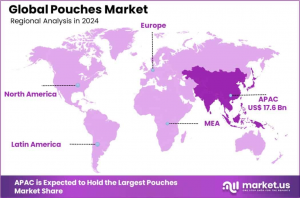

• Asia-Pacific pouches market holds a 38.2% share, valued at USD 17.6 billion.

Pouches Statistics

• In 2023, 16% of surveyed U.S. youth and young adults (aged 15-24) reported ever using nicotine pouches, while 12% were current users.

• Among current nicotine pouch users aged 15-24, 73% also reported current cigarette smoking.

• A 2024 survey found that the average nicotine pouch consumer uses 4.97 cans per week (based on a 20-pouch per equivalent).

• According to the 2024 National Youth Tobacco Survey, 1.8% of U.S. middle and high school students reported current use of nicotine pouches, showing no statistically significant change from 1.5% in 2023.

• Men aged 35-54 had the highest proportion of "high-frequency pouch users" (using 5 or more 20-pouch cans per week).

Key Market Segments

• Plastic remains the dominant material, accounting for 62.1% of the market. Its durability, lightweight, and cost-efficiency make plastic pouches the preferred choice for a wide range of products, from food to healthcare items.

• Standard Treatment dominates, holding 43.2% of the market. These pouches are widely used across industries for their cost-effectiveness and versatility, especially for non-perishable goods, making them a common choice for everyday packaging needs.

• Food and Beverages lead with a 69.2% demand share. Pouches are highly favored in this sector for their ability to preserve freshness, extend shelf life, and maintain food quality, making them essential for packaging a wide range of food and drink products.

• Zipper Closures dominate with a 58.1% market share. Zipper pouches are preferred for their resealability, which helps maintain product freshness and offers added convenience to consumers, especially in food and other perishable goods packaging.

Elevate Your Business Strategy! Purchase the Report for Market-Driven Insights - https://market.us/purchase-report/?report_id=137855

Regulations On Pouches Market

1. Food Safety Standards: Regulations for pouches in the food industry require adherence to strict safety standards. Packaging materials must be non-toxic and approved for direct contact with food. In many regions, food-grade pouches must comply with specific regulations regarding the migration of substances from packaging to food, ensuring no harmful chemicals affect the contents.

2. Recycling and Sustainability Regulations: Governments around the world are focusing on reducing plastic waste, which has led to regulations promoting recyclable and biodegradable pouch materials. Companies must meet these sustainability standards to reduce environmental impact. This includes using materials that are either fully recyclable or made from renewable resources to support circular economy initiatives.

3. Labeling Requirements: Pouch packaging, especially in food and health products, is subject to strict labeling regulations. These rules require clear labeling of product ingredients, nutritional information, expiration dates, and manufacturing details. Compliance with these labeling standards ensures transparency for consumers and helps prevent misleading claims about the product’s quality and contents.

4. Health and Safety Certifications: For pouches used in pharmaceuticals and personal care products, regulatory bodies require packaging materials to be certified for health and safety. This ensures the pouches do not contaminate sensitive products and meet strict hygiene standards. Certifications may include GMP (Good Manufacturing Practices) or ISO certifications to guarantee quality and safety during manufacturing.

5. Customs and Import/Export Regulations: Pouches used in international trade are subject to import/export regulations, which vary by country. These regulations ensure that packaging materials meet local safety, health, and environmental standards. Additionally, some countries require specific certifications for imported packaging materials, affecting how pouches are manufactured, labeled, and shipped across borders.

Key Market Segments

By Type Analysis Stand-up pouches maintain a commanding presence in the market, securing a substantial 58.2% share in 2023. Their popularity can be attributed to their user-friendly design and optimal utilization of retail shelf space, making them a favorite among both consumers and retailers for efficient packaging solutions.

By Material Analysis In 2024, plastic continued to be the material of choice for pouches, claiming a 62.1% market share. The preference for plastic is due to its durability, lightweight characteristics, and cost-effectiveness, which make it suitable for a wide array of applications ranging from food packaging to healthcare products.

By Treatment Type Analysis Standard treatment, pouches led the segment in 2024 with a 43.2% share, favored for their affordability and broad application across the packaging industry. These pouches are especially prevalent in industries packaging non-perishable goods, owing to their versatility and cost-efficiency.

By End-Use Analysis The food and beverages sector dominated the end-use segment of the pouches market in 2024, holding a 69.2% share. Pouches are highly valued in this sector for their ability to maintain product freshness and extend shelf life, crucial for preserving the quality of food products.

By Closure Type Analysis Zipper closures commanded a significant market share of 58.1% in 2024, appreciated for their resealability and effectiveness in maintaining product freshness. This feature makes zippers highly sought after for packaging food items and other perishable goods, offering convenience and extended usability.

By Pouches Weight Analysis Pouches weighing between 20-50 grams represented a significant segment, capturing a 39.2% share in 2024. This weight class is particularly favored in the food and snack sectors for its optimal balance of product quantity and ease of portability, aligning with consumer preferences for moderately sized packaging.

By Sealer Analysis Direct heat sealers dominated the market in 2024 with a 64.1% share, prized for their ability to effectively seal a variety of materials. This sealing method is essential for creating strong, airtight seals that enhance product safety, preserve freshness, and prevent contamination.

Key Market Segments List

By Type

• Stand-up Pouches

• Flat Pouches

• Roll Stock

By Material

• Plastic

• Metal

• Paper

• Bioplastics

By Treatment Type

• Aseptic

• Standard

• Retort

• Hot-Filled

By End Use

• Food and Beverages

• Healthcare

• Personal Care and Cosmetics

• Homecare

• Others

By Closure Type

• Tear Notch

• Zipper

• Spout

By Pouches Weight

• <10 gms

• 10-20 gms

• 20-50 gms

• 50-70 gms

• >70 gms

By Sealer

• Direct Heat Sealer

• Vacuum Pouch Sealer

• Others

Regional Analysis

The Asia-Pacific pouches market holds a dominant 38.2% share, valued at USD 17.6 billion. This region leads the global market due to rapid urbanization, a growing middle class, and expanding retail sectors in key countries such as China and India, making it a crucial area for market growth and expansion.

In North America, the market is driven by the rising consumer demand for convenient and versatile packaging, with the U.S. at the forefront due to its strong food and beverage sector. The increasing preference for easy-to-use, portable packaging continues to fuel demand across multiple industries, particularly in food and healthcare.

Key Players Analysis

• Amcor Plc

• American Packaging Corp.

• Berry Global Inc.

• CCL Industries Inc.

• Clifton Packaging Group Ltd.

• Constantia Flexibles Group GmbH

• Coveris Management GmbH

• Dai Nippon Printing Co. Ltd.

• Goglio SpA

• GUALAPACK S.P.A

• Huhtamaki Group

• Mondi Plc

• Montana Tech Components AG

• Nabtesco Corp.

• Polymer Packaging Inc.

• ProAmpac

• ProAmpac Holdings Inc.

• Sealed Air Corp.

• Smurfit Kappa

• Sonoco Products Co.

• Stora Enso Oyj

• Südpack

• Tetra Pak Group

• UFlex Ltd.

• Winpak Ltd.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Chemical Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release