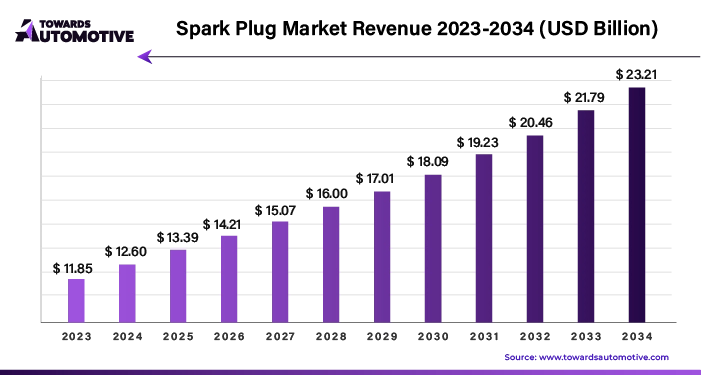

Spark Plug Market Size Expected to Reach USD 23.21 Bn by 2034

The global spark plug market size is calculated at USD 12.60 billion in 2024 and is expected to reach around USD 23.21 billion by 2034, expanding at a solid CAGR of 6.4% from 2024 to 2034.

/EIN News/ -- Ottawa, Aug. 23, 2024 (GLOBE NEWSWIRE) -- The global spark plug market size is predicted to increase from USD 11.85 billion in 2023 to approximately USD 21.79 billion by 2033, according to a study published by Towards Automotive a sister firm of Precedence Research.

Download a short version of this report @ https://www.towardsautomotive.com/insight-sample/1318

Key Takeaways

- Asia Pacific dominated the spark plug market in 2023.

- In 2023, Asia Pacific led the spark plug market with Japan's maritime innovations driving a 7.5% CAGR.

- North America is estimated to grow at the fastest rate during the forecast period.

- By material type, the iridium segment dominated the market in 2023.

- By vehicle type, the automotive segment held the largest share of the market in 2023.

Iridium Spark Plugs: The Superior Choice for Performance and Longevity

Unmatched Durability and Longevity

Iridium spark plugs are renowned for their exceptional durability, offering a significantly longer lifespan compared to traditional copper spark plugs. This extended lifespan results in reduced maintenance costs and fewer replacements over time. Iridium’s unique properties, such as its resistance to high temperatures and electrical stress, make it an ideal material for spark plugs used in demanding conditions.

Thermo-Edge Design Advantages

Many iridium spark plugs feature a thermo-edge design in their central electrodes, which enhances their ability to resist carbon fouling and ensures smooth engine operation. By preventing carbon buildup, these spark plugs help maintain a cleaner and more efficient combustion process, which in turn improves fuel efficiency and overall engine performance.

Cost vs. Performance

Although iridium spark plugs come with a higher price tag compared to copper or platinum plugs, their superior performance and durability make them a worthwhile investment. Iridium plugs can last up to 25% longer than platinum plugs, offering better wear resistance and a longer service life. This long-term value makes them a preferred choice for those seeking high reliability and performance in their engines.

Wide-Ranging Applications

Iridium spark plugs are widely used across various industries, including automotive, marine, aerospace, and other industrial sectors. Their ability to operate at high temperatures and resist carbon fouling makes them ideal for engines that demand reliable ignition and consistent performance. In the automotive sector, where efficient combustion and reduced misfires are crucial for vehicle performance, the demand for iridium spark plugs is particularly strong. The automotive market valued at USD 4,070.19 billion in 2023, is projected to grow to over USD 6,678.28 billion by 2032, with a robust CAGR of over 5.66%

Top Companies in the Spark Plug Market

- Robert Bosch GmbH

- Niterra Co., Ltd (NGK Spark Plugs Co. Ltd.)

- Hella KGaA Hueck & Co.

- Denso Corporation

- Valeo S.A.

- Tenneco Inc.

- Weichai Power Co., Ltd.

- Holley Performance Products, Inc.

- Torch Group

- MAGNETI MARELLI PARTS & SERVICES

- HKS Co., Ltd.

- ACDelco

- Stitt Spark Plug Company

- Pulstar

- Klaxcar France S.A.

- FRAM Group (Autolite)

- Brisk Company

How AI Integration is Transforming the Spark Plug Market

With advanced simulations and predictive analytics, manufacturers can use machine learning algorithms to refine spark plug designs for better fuel efficiency, enhanced engine performance, and extended lifespan. This leads to faster prototyping and fine-tuning, allowing products to meet consumer needs more effectively.

AI-powered diagnostics and maintenance tools are providing real-time monitoring and predictive maintenance for spark plugs. By analyzing data, AI systems can foresee potential failures before they happen, allowing for proactive maintenance. This reduces vehicle downtime and lowers operational costs for vehicle owners, improving overall reliability.

AI is also streamlining supply chain operations in the spark plug market. Intelligent algorithms forecast demand more accurately, manage inventory more efficiently, and optimize logistics. This results in cost savings and better product availability. For example, in January 2024, a new visual inspection app using AI was introduced to speed up and improve the reliability of the final inspection of spark plugs. This app helps in detecting flaws more efficiently, enhancing quality control in manufacturing.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Supply Chain of the Spark Plug Market

The spark plug supply chain involves several key stages:

- Raw Material Sourcing: High-quality metals and ceramics are procured from specialized suppliers.

- Manufacturing: Materials are transported to plants where they undergo molding, firing, and quality testing.

-

Distribution: Finished spark plugs are packaged, stored, and distributed to retailers and automotive repair shops.

Efficient supply chain management is crucial for minimizing delays and ensuring timely delivery. Advanced forecasting and inventory systems help in predicting demand and avoiding stockouts. Technologies like real-time tracking systems enhance transparency and efficiency in logistics.

Spark Plug Market Ecosystem

The spark plug market ecosystem includes various key players:

- Manufacturers: Companies like NGK Spark Plug Co., Denso Corporation, and Bosch lead the market by innovating and producing high-quality spark plugs.

- Suppliers: Provide essential raw materials such as ceramics and metals.

- Distributors: Ensure products reach automotive repair shops and dealerships.

- Aftermarket Service Providers: Offer replacement and maintenance services, driving further market growth.

Together, these players form a robust ecosystem that continuously evolves with technological advancements and market demands, ensuring optimal engine performance and efficiency.

Country-Wise Trends and Opportunities in the Spark Plug Market (2024-2034)

| Region/Country | CAGR (2024-2034) | Key Trends and Opportunities | |

| Japan | 7.5 | % | Leading innovation in maritime advancements |

| China | 6.8 | % | Automotive industry boom |

| India | 7.2 | % | Expanding industrial base and technological advancements |

| South Korea | 6.6 | % | Technological innovation |

| U.S. | 4.5 | % | Defense sector growth |

Asia Pacific led the spark plug market in 2023, and the trend is expected to continue with Japan, China, India, and South Korea driving significant growth.

Japan is set to lead with a robust CAGR of 7.5% during the forecast period. The country's dominance in the maritime industry, being the second-largest shipping and third-largest shipbuilding nation, is fueling this growth. Japan is at the forefront of developing fully autonomous ships, which need advanced spark plugs for reliable ignition. Additionally, Japan's push for decarbonizing maritime transport with alternative fuels like hydrogen and ammonia will further drive demand for sophisticated ignitors. Government initiatives like the 'Blue Economy' and 'Carbon Neutral Ports' are also supporting these advancements, creating new opportunities.

China is also making a strong impact with a projected CAGR of 6.8%. The country’s booming automotive industry, which saw passenger car production and sales both increase significantly in 2023, is a major growth driver. China’s rise as the world’s largest car exporter, with a 58% increase in auto exports in late 2023, highlights its competitive advantage in manufacturing advanced ignitor solutions at lower costs.

India is expected to grow at a CAGR of 7.2%, driven by its expanding industrial base and technological advancements. The country’s growing automotive and defense sectors are increasing demand for advanced ignition systems. Notably, Steelbird International’s collaboration with Hella India to introduce new spark plugs and horns for two-wheelers is a prime example of how India is tapping into these emerging opportunities.

South Korea will see steady growth with a CAGR of 6.6%, thanks to its focus on technological innovation and strong manufacturing capabilities across various sectors, including automotive and defense.

In North America, the U.S. is projected to grow at the fastest rate with a CAGR of 4.5%. The defense sector’s investment in advanced technology, including cybersecurity and autonomous systems, is driving demand for high-performance spark plugs. Companies like Lockheed Martin are leading the way in developing advanced ignitors for military applications, supported by government initiatives such as the 'Defense Innovation Unit' (DIU).

Iridium in the Automotive Sector: Growth and Impact

Iridium is set to lead the automotive sector with a robust compound annual growth rate (CAGR) of 5.8% from 2024 to 2034, thanks to its cost-effectiveness and exceptional durability. Iridium spark plugs, known for their longevity, can last up to 120,000 miles due to the metal’s high melting point of 2,460°C, which ensures resistance to wear under extreme conditions. This durability makes iridium ideal for high-power engines in marine and aircraft applications. The fine wire design of iridium spark plugs delivers a concentrated spark, enhancing fuel combustion and performance. Many modern high-performance vehicles, such as Mercedes-Benz’s AMG GT and Audi’s R8, use iridium spark plugs, reflecting their industry preference.

The automotive sector is experiencing growth driven by increased disposable incomes and consumer spending on luxury vehicles. The expansion of logistics and e-commerce is particularly notable, with rising demand for light commercial vehicles (LCVs) for last-mile delivery and heavy commercial vehicles (HCVs) for global trade. Technological advancements in automotive ignitors are expected to boost fuel efficiency and reduce emissions, underscoring the importance of iridium components in supporting the global transportation infrastructure.

Overview of Key Competitors

In the spark plug sector, leading companies include Hella KGaA Hueck & Co., Denso Corporation, Valeo S.A., and Tenneco Inc. These manufacturers are heavily investing in research and development to introduce new products with enhanced features. Their focus is on developing spark plugs with longer lifespans, improved fuel efficiency, and better overall performance.

Key Trends and Strategies

- Product Innovation: Manufacturers are advancing spark plug technology to meet specific industry requirements. This includes designing spark plugs with extended durability and superior performance characteristics to capture a larger spark plug market share.

- Cost Management: Balancing price with quality is critical. Companies are exploring methods to reduce manufacturing costs while maintaining high performance. This includes experimenting with alternative materials and considering localized production strategies.

- Distribution Channels: To reach a broader audience, companies are diversifying their distribution methods. This strategy involves selling directly to automakers for new vehicles, supplying parts stores and repair shops, and enhancing their online sales platforms.

- Market Expansion: Several major players are expanding their market presence by entering new geographic regions. This includes setting up new manufacturing facilities and forming partnerships with local distributors to better serve diverse markets.

-

Customer Focus: Ensuring customer satisfaction is a top priority. Companies are tailoring their products to meet the diverse needs of various industries and fostering collaborations to stay ahead of innovation trends.

Recent Developments in the Spark Plug Market

- In June 2023, Niterra, based in Nagoya, launched the Nine Laser Iridium Spark Plugs, compatible with vehicles from Stellantis, Honda, Toyota, Subaru, and BMW OEMs. This launch reflects Niterra's commitment to advancing spark plug technology for a range of high-profile automotive brands.

- In May 2024, Niterra expanded its premium NGK Independent Aftermarket (IAM) product line by introducing four new precious metal spark plugs. The addition of a single precious metal upgrade unit to their product lineup underscores their focus on providing high-quality options for aftermarket customers.

-

In March 2024, Niterra extended its official supplier contract with Scuderia Ferrari, the Formula 1 racing team, through a multi-year agreement. This extension highlights Niterra's ongoing commitment to supporting top-tier motorsports with cutting-edge spark plug technology.

Browse More Insights of Towards Automotive:

- The global bicycle chain market size is calculated at USD 7.81 billion in 2024 and is expected to be worth USD 12.85 billion by 2034, expanding at a CAGR of 4.9% from 2023 to 2034.

- The global bicycle reflector market size is calculated at USD 1,295.6 million in 2024 and is expected to be worth USD 2,000.0 million by 2034, expanding at a CAGR of 4.34% from 2023 to 2034.

- The global automotive remote diagnostic market size is calculated at USD 21.92 billion in 2024 and is expected to be worth USD 111.70 billion by 2034, expanding at a CAGR of 17.47% from 2023 to 2034.

- The global rolling stock management market size is calculated at USD 59.34 billion in 2024 and is expected to be worth USD 111.2 billion by 2034, expanding at a CAGR of 6.57% from 2024 to 2034.

- The global dual clutch transmission market size is calculated at USD 98.92 billion in 2024 and is expected to be worth USD 228.57 billion by 2034, expanding at a CAGR of 9.23% from 2023 to 2034.

- The global plug-in hybrid electric vehicle market size is calculated at USD 36.62 billion in 2024 and is expected to be worth USD 193.80 billion by 2034, expanding at a CAGR of 18.3% from 2023 to 2034.

- The global railway rolling stock market size is calculated at USD 3.91 billion in 2024 and is expected to be worth USD 7.07 billion by 2034, expanding at a CAGR of 5.64% from 2023 to 2034.

- The global automotive camshaft market size is calculated at USD 11.14 billion in 2024 and is expected to be worth USD 16.34 billion by 2034, expanding at a CAGR of 3.9% from 2023 to 2034.

- The global automotive carbon ceramic market size is calculated at USD 618.13 million in 2024 and is expected to be worth USD 1638.25 million by 2034, expanding at a CAGR of 10.46% from 2023 to 2034.

- The global automotive performance part market size is calculated at USD 416.88 billion in 2024 and is expected to be worth USD 664.82 billion by 2034, expanding at a CAGR of 4.94%.

Executive Summary

- Market Overview

- Key Market Trends

- Growth Drivers and Restraints

- Market Forecast

Introduction

- Definition and Scope

- Methodology

- Assumptions and Limitations

Market Dynamics

- Market Drivers

- Market Restraints

- Opportunities

- Challenges

Market Segmentation

- By Material

- Iridium

- Platinum

- Nickel

- Others

- By Vehicle

- Automotive

- Marine

- Aerospace

- By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Regional Analysis

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Cross Segmentations

By Material and Vehicle

-

Iridium

- Automotive

- Marine

- Aerospace

-

Platinum

- Automotive

- Marine

- Aerospace

-

Nickel

- Automotive

- Marine

- Aerospace

-

Others

- Automotive

- Marine

- Aerospace

By Material and Sales Channel

- Iridium

-

- OEM

- Aftermarket

- Platinum

-

- OEM

- Aftermarket

- Nickel

-

- OEM

- Aftermarket

- Others

-

- OEM

- Aftermarket

By Material and Region

-

Iridium

- Asia Pacific (China, Japan, India, South Korea, Thailand)

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy, Spain, Sweden, Denmark, Norway)

- Latin America (Brazil, Mexico, Argentina)

- Middle East and Africa (South Africa, UAE, Saudi Arabia, Kuwait)

-

Platinum

- Asia Pacific (China, Japan, India, South Korea, Thailand)

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy, Spain, Sweden, Denmark, Norway)

- Latin America (Brazil, Mexico, Argentina)

- Middle East and Africa (South Africa, UAE, Saudi Arabia, Kuwait)

-

Nickel

- Asia Pacific (China, Japan, India, South Korea, Thailand)

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy, Spain, Sweden, Denmark, Norway)

- Latin America (Brazil, Mexico, Argentina)

- Middle East and Africa (South Africa, UAE, Saudi Arabia, Kuwait)

-

Others

- Asia Pacific (China, Japan, India, South Korea, Thailand)

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy, Spain, Sweden, Denmark, Norway)

- Latin America (Brazil, Mexico, Argentina)

- Middle East and Africa (South Africa, UAE, Saudi Arabia, Kuwait)

By Vehicle and Sales Channel

-

Automotive

- OEM

- Aftermarket

-

Marine

- OEM

- Aftermarket

-

Aerospace

- OEM

- Aftermarket

By Vehicle and Region

-

Automotive

- Asia Pacific (China, Japan, India, South Korea, Thailand)

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy, Spain, Sweden, Denmark, Norway)

- Latin America (Brazil, Mexico, Argentina)

- Middle East and Africa (South Africa, UAE, Saudi Arabia, Kuwait)

-

Marine

- Asia Pacific (China, Japan, India, South Korea, Thailand)

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy, Spain, Sweden, Denmark, Norway)

- Latin America (Brazil, Mexico, Argentina)

- Middle East and Africa (South Africa, UAE, Saudi Arabia, Kuwait)

-

Aerospace

- Asia Pacific (China, Japan, India, South Korea, Thailand)

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy, Spain, Sweden, Denmark, Norway)

- Latin America (Brazil, Mexico, Argentina)

- Middle East and Africa (South Africa, UAE, Saudi Arabia, Kuwait)

By Sales Channel and Region

-

OEM

- Asia Pacific (China, Japan, India, South Korea, Thailand)

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy, Spain, Sweden, Denmark, Norway)

- Latin America (Brazil, Mexico, Argentina)

- Middle East and Africa (South Africa, UAE, Saudi Arabia, Kuwait)

-

Aftermarket

- Asia Pacific (China, Japan, India, South Korea, Thailand)

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy, Spain, Sweden, Denmark, Norway)

- Latin America (Brazil, Mexico, Argentina)

- Middle East and Africa (South Africa, UAE, Saudi Arabia, Kuwait)

Go-to-Market Strategies (Region Selection)

-

Product Strategy

- Product Differentiation

- Innovation and Development

- Quality and Performance

-

Pricing Strategy

- Pricing Models

- Competitive Pricing

- Value-based Pricing

-

Distribution Strategy

- Distribution Channels

- Partnerships and Alliances

- Supply Chain Management

-

Promotion and Marketing Strategy

- Advertising and Branding

- Digital Marketing

- Trade Shows and Exhibitions

-

Sales Strategy

- Sales Channels

- Direct vs. Indirect Sales

- Sales Team Structure and Training

-

Customer Engagement Strategy

- Customer Relationship Management (CRM)

- Customer Feedback and Support

- Loyalty Programs

-

Geographic Strategy

- Market Entry Strategies for Key Regions

- Localization and Adaptation

- Regional Partnerships and Collaborations

Integration of AI in Spark Plug Market

Introduction

- Definition of AI in the Spark Plug Market

- Overview of AI Technologies

- Scope and Objectives

AI Integration in Product Development

- AI-Driven Design and Prototyping

- Predictive Analytics for Performance Optimization

- Materials Innovation through AI

Manufacturing and Production Enhancement

- Automation and Robotics

- Quality Control and Defect Detection

- Process Optimization and Efficiency

Supply Chain and Logistics

- Demand Forecasting

- Inventory Management

- Supplier and Distribution Network Optimization

Sales and Marketing Strategies

- AI-Powered Customer Insights and Personalization

- Targeted Marketing Campaigns

- Predictive Sales Analytics

Customer Service and Support

- AI Chatbots and Virtual Assistants

- Predictive Maintenance and Service

- Enhanced Customer Feedback and Response

Competitive Advantage

- Differentiation through AI

- Case Studies of AI Implementation by Key Players

- Strategic Benefits of AI Integration

Production and Consumption Data

Introduction

- Scope and Objectives

- Methodology

Global Production Data

- Total Production Volume

- Key Producing Regions

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

- Major Production Facilities and Companies

- Production Trends and Forecast

Global Consumption Data

- Total Consumption Volume

- Key Consuming Regions

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

- Major Consumer Sectors

- Automotive

- Marine

- Aerospace

- Consumption Trends and Forecast

Production and Consumption by Material

- Iridium

- Platinum

- Nickel

- Others

Production and Consumption by Vehicle Type

- Automotive

- Marine

- Aerospace

Regional Analysis

- Asia Pacific

- Production vs. Consumption Overview

- Key Trends and Insights

- North America

- Production vs. Consumption Overview

- Key Trends and Insights

- Europe

- Production vs. Consumption Overview

- Key Trends and Insights

- Latin America

- Production vs. Consumption Overview

- Key Trends and Insights

- Middle East and Africa

- Production vs. Consumption Overview

- Key Trends and Insights

Supply Chain Analysis

- Key Players in the Supply Chain

- Supply Chain Challenges

- Impact on Production and Consumption

Market Dynamics

- Factors Affecting Production

- Factors Affecting Consumption

Future Outlook

- Projected Production and Consumption Trends

- Market Opportunities and Risks

Strategic Planning

Opportunity Assessment

-

Market Opportunities

- Identification of High-Growth Areas

- Emerging Market Segments

- Customer Needs and Preferences

-

Emerging Trends

- Technological Advancements

- Market Dynamics and Shifts

- Consumer Behavior Trends

-

Competitive Landscape Analysis

- Key Competitors and Market Share

- Competitive Strategies and Positioning

- Benchmarking and Best Practices

-

SWOT Analysis

-

Strengths

- Internal Capabilities and Resources

- Competitive Advantages

-

Weaknesses

- Internal Limitations

- Areas for Improvement

-

Opportunities

- Market Growth and Expansion

- Strategic Partnerships

-

Threats

- Market Risks and Challenges

- Competitive Pressures

-

Strengths

New Product Development

-

Market Needs and Gaps

- Analysis of Current Market Offerings

- Identification of Unmet Needs

- Consumer Feedback and Research

-

Product Innovation and Design

- Innovation Frameworks and Methodologies

- Design Thinking and User-Centered Design

- Prototype Development and Testing

-

Development Process and Stages

- Stage-Gate Process

- Agile Development Methodologies

- Product Lifecycle Management

-

Case Studies of Successful Product Launches

- Overview of Notable Launches

- Key Success Factors

- Lessons Learned and Best Practices

Plan Finances/ROI Analysis

-

Financial Planning and Budgeting

- Budget Allocation and Management

- Financial Projections and Forecasting

-

ROI Metrics and Evaluation

- Key Performance Indicators (KPIs)

- Return on Investment Calculation

- Financial Metrics and Analysis

-

Cost-Benefit Analysis

- Cost Estimation Techniques

- Benefit Measurement and Comparison

-

Investment and Funding Strategies

- Sources of Capital and Investment

- Funding Models and Structures

- Risk Assessment and Mitigation

Supply Chain Intelligence/Streamline Operations

-

Supply Chain Analysis and Mapping

- Supply Chain Structure and Components

- Mapping and Visualization Techniques

-

Key Challenges and Solutions

- Common Supply Chain Issues

- Strategies for Addressing Challenges

-

Streamlining Operations for Efficiency

- Process Optimization Techniques

- Lean Manufacturing and Six Sigma

-

Technologies and Tools for Supply Chain Optimization

- Advanced Technologies (IoT, AI, Blockchain)

- Software and Tools for Supply Chain Management

Cross-Border Intelligence

-

Global Market Entry Strategies

- Market Entry Models and Approaches

- Risk and Opportunity Assessment

-

Regulatory and Compliance Considerations

- International Trade Regulations

- Compliance with Local Laws and Standards

-

Cross-Border Partnerships and Alliances

- Partnership Models and Agreements

- Strategic Alliances and Joint Ventures

-

Market Adaptation and Localization

- Localization Strategies

- Adapting Products and Services for Local Markets

Business Model Innovation

-

Types of Business Models

- Overview of Business Model Types

- Traditional vs. Modern Models

-

Innovation in Business Models

- Techniques for Business Model Innovation

- Case Studies of Innovative Models

-

Impact on Market Position and Competitiveness

- Competitive Advantage through Innovation

- Impact on Market Share and Position

-

Examples of Disruptive Business Models

- Disruptive Innovations and Technologies

- Success Stories and Industry Impact

Blue Ocean vs. Red Ocean Strategies

-

Definition and Concept of Blue Ocean and Red Ocean Strategies

- Explanation of Blue Ocean Strategy

- Explanation of Red Ocean Strategy

-

Comparative Analysis

- Key Differences and Similarities

- Advantages and Disadvantages

-

Implementing Blue Ocean Strategies

- Steps for Creating Blue Oceans

- Tools and Frameworks for Implementation

-

Case Studies and Examples

- Successful Blue Ocean Strategies

- Lessons Learned from Blue Ocean Implementations

Competitive Landscape

- Market Share Analysis

- Company Profiles

- Robert Bosch GmbH

- Niterra Co., Ltd (NGK Spark Plugs Co. Ltd.)

- Hella KGaA Hueck & Co.

- Denso Corporation

- Valeo S.A.

- Tenneco Inc.

- Weichai Power Co., Ltd.

- Holley Performance Products, Inc.

- Torch Group

- MAGNETI MARELLI PARTS & SERVICES

- HKS Co., Ltd.

- ACDelco

- Stitt Spark Plug Company

- Pulstar

- Klaxcar France S.A.

- FRAM Group (Autolite)

- Brisk Company

Market Trends and Developments

- Technological Advancements

- Product Innovations

- Strategic Initiatives by Key Players

Consumer Insights

- Preferences and Buying Behavior

- Market Surveys and Feedback

Regulatory Landscape

- Standards and Regulations

- Compliance and Certification

Future Outlook

- Market Forecast and Projections

- Emerging Trends

Appendices

- Glossary of Terms

- Data Sources

- Research Methodology

- Contact Information

Acquire our comprehensive analysis today @ https://www.towardsautomotive.com/price/1318

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Subscribe to our Annual Membership and gain access to the latest insights and statistics in the automotive industry. Stay updated on automotive industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the competition with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of automotive: Get a Subscription

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing packaging world.

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardshealthcare.com

Web: https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive

Distribution channels: Business & Economy ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release