Robo Advisory Market Size and Forecast (2022-2030) | By Top Leading Players Fincite, Betterment, Ellevest

Robo Advisory Market

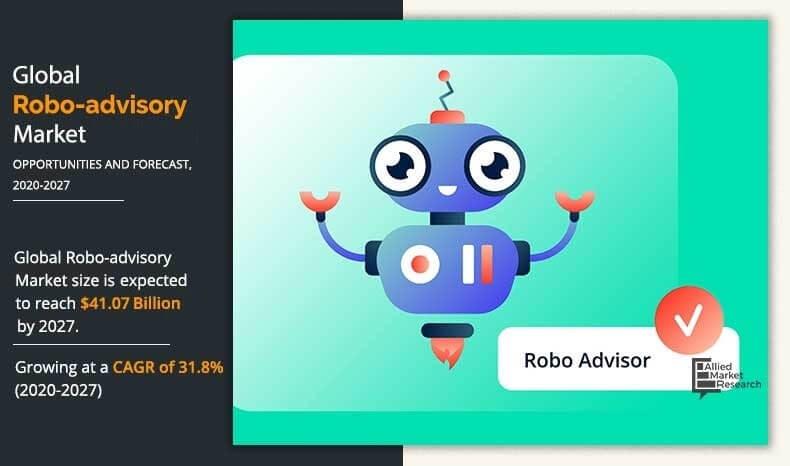

PORTLAND, OREGAON, UNITED SATES, October 2, 2022 /EINPresswire.com/ -- Allied Market Research published a report, titled, "Robo Advisory Market By Business Model (Pure Robo Advisors and Hybrid Robo Advisors), Service Providers (FinTech Robo Advisors, Banks, Traditional Wealth Managers and Others), Service Type (Direct Plan-based/Goal-based and Comprehensive Wealth Advisory), and End User (Retail Investor and High Net Worth Individuals (HNIs)): Global Opportunity Analysis and Industry Forecast, 2020-2027". According to the report, the global robo advisory industry garnered $4.51 billion in 2019, and is projected to generate $41.07 billion by 2027, manifesting a CAGR of 31.8% from 2020 to 2027.

Prime Determinants of Growth

Surge in adoption of advanced technologies, trend of digitization in financial institutions, and favorable government initiatives drive the growth of the global robo advisory market. However, security & compliance issues restrain the market growth. On the contrary, technological innovations and potential in developing countries are expected to provide new opportunities in the coming years.

Download Sample Report@ https://www.alliedmarketresearch.com/request-sample/2105

Covid-19 Scenario:

Robo-advisors have been adopted extensively for wealth and assets management during the fluctuating conditions of the market taking place during the Covid-19 pandemic. These advisors assist in preventing investors from illogical and impulsive decision-making during times like these.

As robo advisors offers a huge exposure to individuals to gain expertise in diversification & management of the portfolio by investing in stocks, bonds, and certificate of deposit (CD), the need of these services gained traction to survive and sustain during the turbulent economic conditions.

The Hybrid Robo Advisors Segment to Retain Its Dominance By 2027

By business model, the hybrid robo-advisors segment accounted for the largest market share, contributing to nearly four-fifths of the global robo advisory market in 2019, and will continue its lead position during the forecast period. Moreover, this segment is expected to register the largest CAGR of 32.6% from 2020 to 2027. This is attributed to increase in international trades & investments and rise in requirements for customized portfolios for funds. The report also discusses the pure robo-advisors segment.

The HNIs Segment to Maintain Its Dominance in Terms of Revenue By 2027

By end user, the HNIs segment contributed to the largest share in 2019, holding around two-thirds of the global robo advisory market, and is projected to maintain its dominance in terms of revenue by 2027. This is due to massive shift toward HNIs from traditional advisory services in developed and developing countries. However, the retail segment is expected to manifest at the fastest CAGR of 33.6% from 2020 to 2027, owing to increase in adoption of automated portfolio management across the globe.

North America to Maintain Its Leadership Status By 2027

By region, North America contributed to the highest market share in 2019, accounting for more than half of the global robo advisory market, and will maintain its leadership status by 2027. This is due to investments in mutual funds or ETFs made through robo advisor software. However, Asia-Pacific is expected to witness the highest CAGR of 34.8% during the forecast period, owing to key market players of the software establishing their presence in the emerging countries including China and India.

Interested to Procure the Data? Inquire Here @ https://www.alliedmarketresearch.com/purchase-enquiry/2105

Leading Market Players

Betterment

Charles Schwab Corporation

Blooom

Personal Capital Corporation

FMR LLC

SIGFIG

SoFi

Wealthfront Corporation

The Vanguard Group, Inc.

WiseBanyan, Inc.

Similar Reports:

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

David Correa

Allied Analytics LLP

800-792-5285

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.