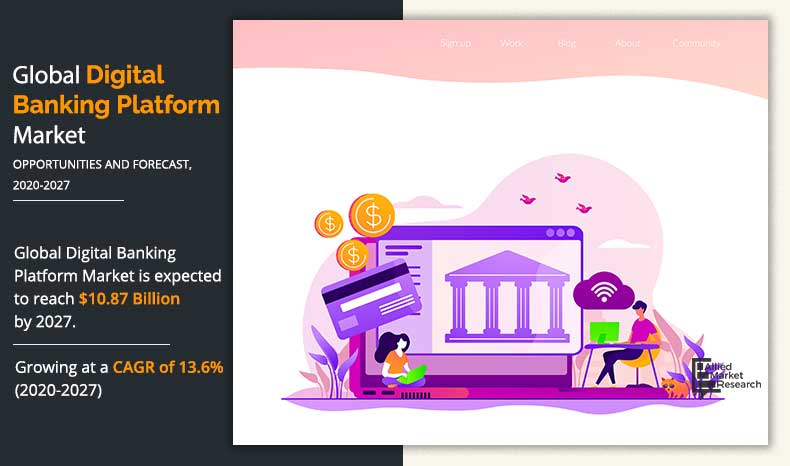

Digital Banking Platforms Market by Component, Deployment Model, Type, and Banking Mode 2020–2027

Digital Banking Platforms Market 2020–2027

PORTLAND, OR, UNITED STATES, March 7, 2022 /EINPresswire.com/ -- Allied Market Research (USA, Oregon, Portland) Published Latest Report titled, ‘Digital Banking Platform Market by Component (Solution and Service), Deployment Model (On-Premise and Cloud), Type (Retail Banking and Corporate Banking), and Banking Mode (Online Banking and Mobile Banking): Global Opportunity Analysis and Industry Forecast, 2020–2027’.

This market research study determines the increase in changes and the aspects which are likely to have an impact on the Digital Banking Platforms Market growth. Increased demand for the technologies is also one of the factors, which are likely to boost the growth of this industry. The market research study uses several tools and techniques which are used for the determination of the growth of the Digital Banking Platforms Market.

Download Report Sample with Industry Insights @ https://www.alliedmarketresearch.com/request-sample/5539

Digital Banking Platforms Market Competitive Analysis:

Top 10 players in this industry profiled in the report include Appway, COR Financial Solution Ltd., Edgeverve, FIS Global, Fiserv, Inc, nCino, Oracle Corporation, SAP SE, Temenos, and Vsoft Corporation.

These players have adopted various strategies including expansions, mergers & acquisitions, joint ventures, new product launches, and collaborations to gain a strong position in the industry.

COVID-19 Scenario Analysis:

• Global Digital Banking Platforms Market size has been significantly impacted by the COVID-19 outbreak. New projects throughout the world have stalled, which, in turn, have led to decline in demand for the market.

• Global factories have struggled to integrate new products as workers have stayed in their homes, which disrupted the global supply chains.

• The impact of COVID-19 on this market is temporary as just the production and supply chain is stalled. Once the situation improves, production, supply chains, and demand for hybrid chips are gradually going to increase.

• This COVID-19 lockdown would help companies think about more advanced products to enhance efficiency.

Get Detailed COVID-19 Impact Analysis on the Digital Banking Platforms Market @ https://www.alliedmarketresearch.com/request-for-customization/5539?reqfor=covid

The report is also used in the analysis of the growth rates and the threats of new entrants, which are used for the determination of the growth of the market for the estimated forecast period. Moreover, increased demand for the factors influencing the growth of the market is also one of the major aspects which is likely covered in depth in the report.

One of the methods for the determination of the growth of the market is the increased use of the statistical tools, which is used for the estimation of the growth of the market for the estimated forecast period. SWOT analysis is one of the methods for the determination of the growth of the Digital Banking Platforms Market. These tools are also used for the determination of the major players for the growth of the market for the estimated forecast period.

This report focuses and highlights the strategies and the trends, in which the manufacturer and the company is likely to move. The research study is also known to provide in depth analysis of the reports which is one of the key aspects for the growth of the Digital Banking Platforms Market.

Make Purchase Inquiry @ https://www.alliedmarketresearch.com/purchase-enquiry/5539

The study covers the production, sales, and revenue of various top players in the Digital Banking Platforms Market, therefore enabling customers to achieve thorough information of the competition and henceforth plan accordingly to challenge them head on and grasp the maximum market share. This report is filled with significant statistics and information for the consumers to attain in-depth data of the Digital Banking Platforms Market growth.

Market segments are also an important aspect of any market research study. Reports are product based, they also includes information on sales channel, distributors, traders and dealers. This helps in efficient planning and execution of supply chain management as it drastically affects the overall operations of any business. The up-to-date, complete product knowledge, end users, industry growth will drive the profitability and revenue. Digital Banking Platforms Market report studies the current state of the market to analyse the future opportunities and risks.

The research offers a detailed segmentation of the global Digital Banking Platforms Market. Key segments analysed in the research include type, applications, industry verticals and geography. Extensive analysis of sales, revenue, growth rate, and market share of each segment for the historic period and the forecast period is offered with the help of tables.

The Digital Banking Platforms Market size is analysed based on regions and competitive landscape in each region is mentioned. Regions discussed in the study include North America (United States, Canada and Mexico), Europe (Germany, France, UK, Russia and Italy), Asia-Pacific (China, Japan, Korea, India and Southeast Asia), South America (Brazil, Argentina, Colombia), Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa). These insights help to devise strategies and create new opportunities to achieve exceptional results.

Our Report Offers:

• Evaluation of market share for regional and country-level segments.

• Market share analysis of top industry players.

• Strategic recommendations for new entrants.

• All mentioned segments, and regional market forecasts for the next 10 years.

• Market Trends (Drivers, Difficulties, Opportunities, Threats, Challenges, Investment Opportunities and Recommendations)

• Strategic recommendations in the main business segment of the market forecast.

• Competitive landscaping of major general trends.

• Company profiling with detailed strategy, financial and recent developments.

• Latest technological progress mapping supply chain trends.

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of Market Research Reports and Business Intelligence Solutions. AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

David Correa

Allied Analytics LLP

help@alliedanalytics.com

Visit us on social media:

Facebook

Twitter

LinkedIn

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.