Business

Trump Pauses Tariffs Amid Market Turmoil, Raises Chinese Tax

WASHINGTON (AP) — In a surprising pivot on Wednesday, President Donald Trump announced a temporary pause on tariffs impacting most nations for 90 days while simultaneously escalating tariffs on Chinese imports to 125 percent. This decision came amidst intense scrutiny from lawmakers and concerns about the potential fallout for the U.S. economy.

The announcement followed days of market volatility, as the S&P 500 index had seen significant declines due to fears that the ongoing trade war might propel the nation into a recession. Stock prices surged after Trump’s announcement, with the S&P 500 jumping 9.5%, marking one of the best days for the index in recent history.

In earlier comments, Trump attributed his decision to a desire for negotiations, stating that over 75 countries had reached out to the U.S. for trade discussions. “I have authorized a 90-day PAUSE, and a substantially lowered reciprocal tariff during this period, of 10 percent, also effective immediately,” Trump posted on social media.

Simultaneously, Treasury Secretary Scott Bessent characterized the pause as part of a strategic negotiation plan, emphasizing the U.S.’s commitment to engaging with global trade partners in good faith. Bessent noted, “The negotiations would be bespoke,” indicating tailored discussions with different nations.

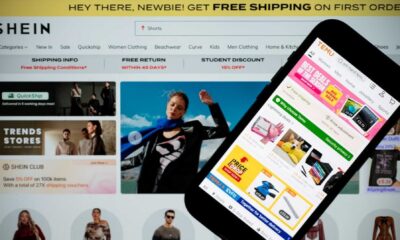

However, the increase in tariffs on Chinese goods from an already high level to 125 percent serves as a stark warning of continuing tensions between the two largest global economies. China‘s Commerce Ministry, responding to the announcement, declared a resolute commitment to countermeasure abilities, asserting, “If the U.S. insists on further escalating its economic and trade restrictions, China will fight to the end.”

In a series of Senate hearings this week, skepticism from Republican lawmakers was palpable, with many openly questioning the rationale behind the administration’s tariff strategy. Senator Thom Tillis of North Carolina directly asked U.S. Trade Representative Jamieson Greer whom he should blame if the economic situation worsened, reflecting widespread anxiety among GOP members about potential repercussions for American consumers and businesses.

“It looks like your boss just pulled the rug out from under you,” Tillis asserted. “This is amateur hour, and it needs to stop,” echoed Representative Steven Horsford of Nevada, who highlighted the tariffs’ adverse effects on consumer spending and the broader market, stressing that American households could face higher prices as a result.

Despite some Republicans offering muted support for continued negotiations, others expressed concerns over the unpredictability of Trump’s strategy and its impact on the stock market trajectory. Senator Steve Daines from Montana noted he was “very encouraged” by the initiation of negotiations but raised alarm over inevitable inflation due to higher tariffs.

In a related sentiment, Delta Air Lines CEO Ed Bastian remarked on the turbulence caused by Trump’s announcements, indicating that the uncertainty has disrupted planning and lowered demand for air travel. “Trying to do it all at the same time has created chaos in terms of being able to make plans,” Bastian stated.

While the recent stock market rally signals some investor optimism, analysts stress the long-term impacts of Trump’s policies remain unclear. With certain tariffs still in place on products like autos and steel, the fallout could linger, and markets are expected to react further as negotiations progress.

Looking ahead, it remains uncertain how Trump will navigate the delicate balance of maintaining economic stability while pursuing his trade agenda. The 90-day pause could provide a critical window for negotiations but also hold the risk of escalating tensions if not managed effectively.