Canada needs an economic statecraft strategy to address its vulnerabilities

Introduction

Canada is facing economic threats from China and Russia targeting its critical industries and infrastructure. The Business Council of Canada, which consists of CEOs of top Canadian companies, identified cyberattacks, theft of intellectual property, Chinese influence on Canada’s academic sector, and trade weaponization by China among the top economic threats to Canada.

More recently, a new and unexpected threat emerged from the United States, when Washington announced 25 percent tariffs on all Canadian goods except for the 10 percent tariffs on energy. To address threats from Russia and China and reduce trade overdependence on the United States, Canada’s federal government will need to consolidate economic power and devise an economic statecraft strategy that will leverage Canada’s economic tools to mitigate these economic threats and vulnerabilities. This paper covers the following topics and offers recommendations:

- Economic threats to Canada’s national security

- An unexpected threat: Overdependence on trade with the United States

- Lack of economic power consolidation by Canada’s federal government

- Mapping Canada’s economic statecraft systems: Sanctions, export controls, tariffs, and investment screening

Economic threats to Canada’s national security

Cyberattacks on Canada’s critical infrastructure

Canada’s critical infrastructure has become a target of state-sponsored cyberattacks. In 2023, Canada’s Communications Security Establishment (CSE)—a signals intelligence agency—said that Russia-backed hackers were seeking to disrupt Canada’s energy sector. Apart from accounting for 5 percent of Canada’s gross domestic product (GDP), the energy sector also keeps the rest of Canada’s critical infrastructure functioning. CSE warned that the threat to Canada’s pipelines and physical infrastructure would persist until the end of the war in Ukraine and that the objective was to weaken Canada’s support for Ukraine.

Beyond critical infrastructure, Canadian companies lost about $4.3 billion due to ransomware attacks in 2021. More recently in February 2025, Russian hacking group Seashell Blizzard was reported to have targeted energy and defense sectors in Canada, the United States, and the United Kingdom. Russia and other adversarial states will likely continue targeting Canada’s critical infrastructure and extorting ransom payments from Canadian companies.

Theft of intellectual property

Canadian companies have become targets of Chinese state-sponsored intellectual theft operations. In 2014, a Chinese state-sponsored threat actor stole more than 40,000 files from the National Research Council’s private-sector partners. The National Research Council is a primary government agency dedicated to research and development in science and technology. Apart from undermining Canadian companies, theft of Canada’s intellectual property, especially research on sensitive technologies, poses a threat to Canada’s national security.

Chinese influence on Canada’s academic sector

Adversarial states have taken advantage of Canada’s academic sector to advance their own strategic and military capabilities. For example, from 2018 to 2023, Canada’s top universities published more than 240 joint papers on quantum cryptography, space science, and other advanced research topics along with Chinese scientists working for China’s top military institutions. In January 2024, Canada’s federal government named more than one hundred institutions in China, Russia, and Iran that pose a threat to Canada’s national security. Apart from calling out specific institutions, the federal government also identified “sensitive research areas.” Universities or researchers who decide to work with the listed institutions on listed sensitive topics will not be eligible for federal grants.

Trade weaponization by China

Trade weaponization by China has undermined the economic welfare of Canadians and posed a threat to the secure functioning of Canada’s critical infrastructure. For example, between 2019 and 2020, China targeted Canada’s canola sector with 100 percent tariffs, restricting these imports and costing Canadian farmers more than $2.35 billion in lost exports and price pressure. In Canada’s 2024 Fall Economic Statement, which outlined key measures to enhance Canadian economic security, the Ministry of Finance announced its plans to impose additional tariffs on Chinese imports to combat China’s unfair trade practices. These included tariffs on solar products and critical minerals in early 2025, and on permanent magnets, natural graphite, and semiconductors in 2026.

However, the imposition of 25 percent tariffs by Washington on both Canada and China could result in deepening trade ties between the two. Canada exported a record $2 billion in crude oil to China in 2024, accounting for half of all oil exports through the newly expanded Trans Mountain pipeline. Increased trade with China would increase Canada’s exposure to China’s coercive practices, and would be a direct consequence of US tariffs on Canada.

An unexpected threat: Overdependence on trade with the United States

A new and unexpected threat to Canada’s economic security emerged from the United States when the Trump administration threatened to impose 25 percent tariffs on all Canadian goods (except for the 10 percent tariffs on energy imports). The United States is Canada’s largest export market, receiving a staggering 76 percent of Canada’s exports in 2024. Canada relies on the United States particularly in the context of its crude oil trade, shipping 97.4 percent of its crude oil to the United States.

Canada had already started working on expansion to global markets through pipeline development even before Washington announced tariffs. It has succeeded in the expansion of the Trans Mountain pipeline in May 2024, which has enabled the export of Canadian oil to Asia. Canada is reviving talks on the canceled Energy East and Northern Gateway pipelines—the former would move oil from Alberta to Eastern Canada, and the latter would transport oil from Alberta to British Columbia for export to Asian markets.

In addition to oil trade, another area where Canada is highly dependent on the United States is in auto manufacturing. Behind oil exports, motor vehicles account for the largest share of Canadian exports to the United States, resulting in exports valued at $50.76 billion (C$72.7 billion Canadian dollars) in 2024. With 25 percent tariffs on all Canadian goods, the automotive industry is expected to take a hit, especially as components cross the border six to eight times before final assembly.

Figure 1

The United States invoked the International Emergency Economic Powers Act to impose tariffs on Canada with the stated objective to curb fentanyl flows to the United States. The measure has plunged US-Canada relations into chaos and could result in a trade war between the two long-standing allies. In response, Canada might reroute oil shipments to China through existing pipelines and increase trade with China in general. Further economic integration with China would increase Canada’s exposure to economic threats emanating from China, including trade weaponization and anti-competitive practices.

Because of US tariffs, Canada could also face challenges in strengthening the resilience of its nuclear fuel and critical mineral supply chains. In the 2024 Fall Economic Statement, Canada outlined key measures for its economic security that heavily incorporated US cooperation. This included plans to strengthen nuclear fuel supply chain resiliency away from Russian influence, with up to $500 million set aside for enriched nuclear fuel purchase contracts from the United States. Canada also aims to strengthen supply chains for responsibly produced critical minerals, following a $3.8 billion investment in its Critical Minerals Strategy, which relies on the United States as a key partner. Given the tariffs, Canada will need to diversify its partners and supply sources quickly if it wishes to maintain these economic security goals.

Could the US-Canada trade war upend defense cooperation?

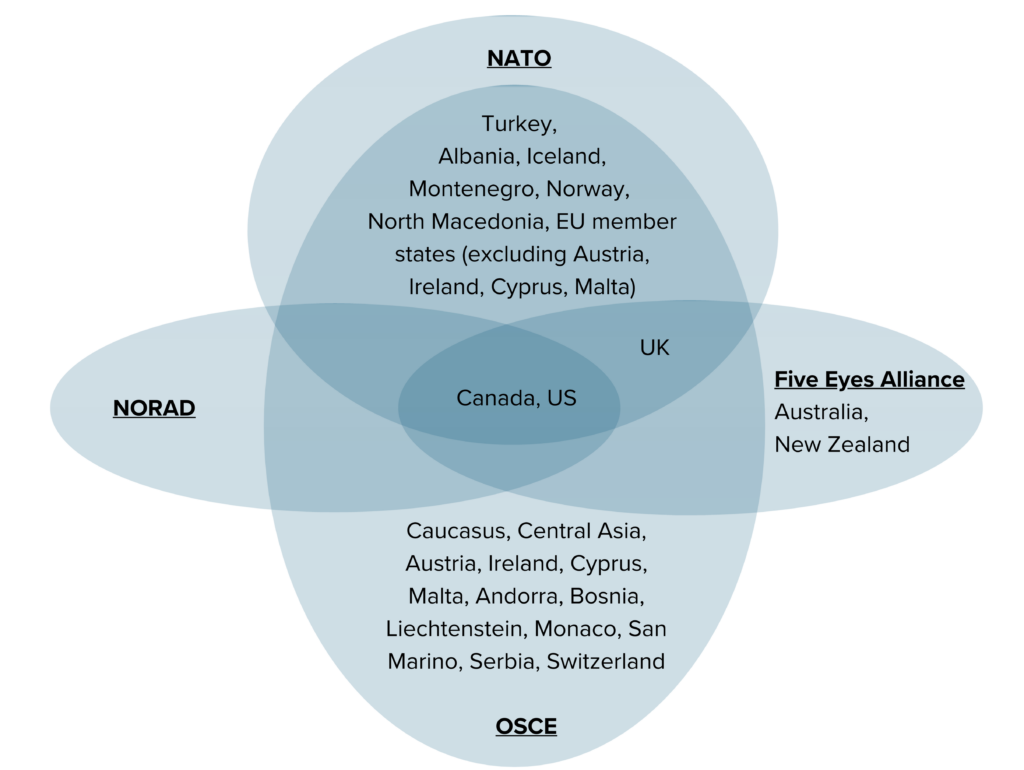

Recent tariff escalation between the United States and Canada has raised questions about the future of military cooperation between the two countries. Apart from being members of the North Atlantic Treasury Organization (NATO), the United States and Canada form a unique binational command called North American Aerospace Defense Command (NORAD). NORAD’s mission is to defend North American aerospace by monitoring all aerial and maritime threats. NORAD is headquartered at Peterson Space Force Base in Colorado, has a US Commander and Canadian Deputy Commander, and has staff from both countries working side by side.

NORAD’s funding has been historically split between the United States (60 percent) and Canada (40 percent). However, the Department of Defense (DoD) does not allocate specific funding to NORAD and does not procure weapons or technology for NORAD, although NORAD uses DoD military systems once fielded. The US Congress recognized the need to allocate funding to modernize NORAD’s surveillance systems after the Chinese spy balloon incident in February 2023. While US fighter jets shot down the Chinese surveillance balloon after it was tracked above a US nuclear weapons site in Montana, the incident exposed weaknesses in NORAD’s capabilities. After the incident, former NORAD Commander Vice Admiral Mike Dumont stated that NORAD’s radar network is essentially 1970s technology and needs to be modernized.

A year before the incident, the Canadian government had committed to invest $3.6 billion in NORAD over six years from 2022 to 2028, and $28.4 billion over twenty years (2022-2042) to modernize surveillance and air weapons systems. However, Canada has fallen short on delivering on these commitments.

In March 2025, Canada’s Prime Minister Mark Carney announced that Canada made a $4.2 billion deal with Australia to develop a cutting-edge radar to detect threats to the Arctic. The radar is expected to be delivered by 2029 and will be deployed under NORAD. Canadian military officials have stated that the US military has supported the deal, signaling that the deterioration of economic relations has not (yet) had spillover effects for the defense cooperation.

However, Prime Minister Carney has also ordered the review of F-35 fighter jet purchases from US defense company Lockheed Martin, citing security overreliance on the United States. Under the $13.29 billion contract with Lockheed Martin, Canada was set to buy 88 fighter jets from the US company. While Canada’s defense ministry will purchase the first sixteen jets to meet the contract’s legal requirements, Canada is actively looking for alternative suppliers.

As the trade war continues, Canada will likely enhance defense cooperation with the European and other like-minded states, possibly to the detriment of the US defense industry and the US-Canada defense cooperation.

Figure 2: US-Canada overlapping memberships in security organizations and alliances

Lack of economic power consolidation by Canada’s federal government

Canada has a range of economic tools and sources of economic power to respond to emerging economic threats and mitigate vulnerabilities; however, it currently lacks economic power consolidation. Unlike the United States, where the federal government can regulate nearly all economic activity, Canada’s Constitution Act of 1867 grants provinces control over their “property and civil rights,” including natural resources. Section 92A, which was added to the constitution in 1982, further reinforced the provinces’ control over their natural resources. Meanwhile, the federal government has control over matters of international trade including trade controls. However, when international trade issues concern the natural resources of provinces, tensions and disagreements often arise between provinces and the federal government, and the lack of economic power consolidation by the federal government becomes obvious.

This issue manifested when the United States announced 25 percent tariffs on Canada in March 2025 as Canada’s federal government and the Alberta province had different reactions. Canada’s main leverage over the United States is oil exports. Refineries in the United States, particularly those in the Midwest, run exclusively on Canadian crude oil, having tailored their refineries to primarily process the heavy Canadian crude. Since 2010, Canadian oil accounted for virtually 100 percent of the oil imported by the Midwest. Threatening to hike levies on crude oil exports could have been Canada’s way of leveraging energy interdependence to respond to US tariffs. However, Alberta Premier Danielle Smith stated that Alberta, which is Canada’s largest oil producer and top exporter of crude oil to the United States, would not hike levies on oil and gas exports to the United States. Being unable to speak in one voice as a country even during a crisis is a direct consequence of Canada’s regional factionalism, characterized by each province looking out for their own interests.

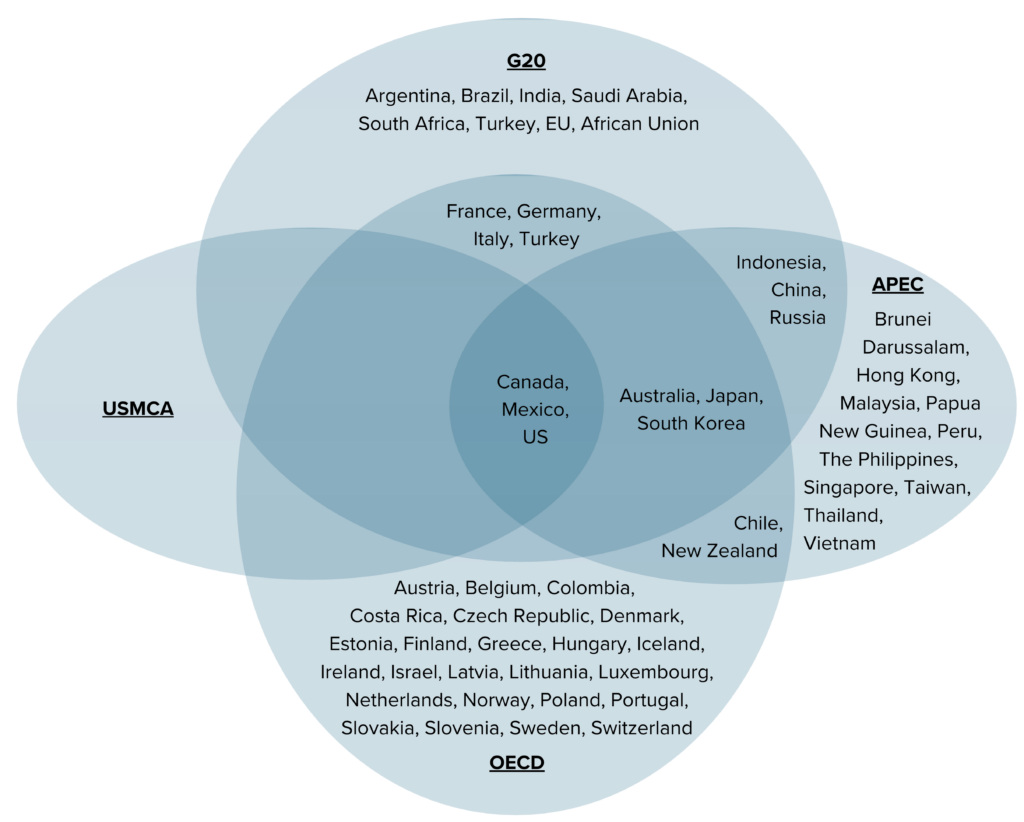

The United States-Mexico-Canada (USMCA) trade agreement, which entered into force during the first Trump administration in July 2020, may have also contributed to diminishing the economic power of Canada’s federal government. Article 32.10 of USMCA requires each member of the agreement to notify other countries if it plans to negotiate a free trade agreement (FTA) with a nonmarket economy. Thus, if Canada were to sign an FTA with China, the United States and Mexico could review the agreement and withdraw from USMCA with six months’ notice. After the USMCA was signed, Canadian scholars wrote that this clause would effectively turn Canada into a vassal state of the United States, with the authority to make decisions on internal affairs but having to rely on the larger power for foreign and security policy decisions. Five years later, it looks like the USMCA has put Canada in a difficult position, being targeted by US tariffs and not having advanced trading relations with other countries.

Figure 3: US-Canada overlapping memberships in economic organizations and alliances

Mapping Canada’s economic statecraft systems

To secure Canada’s critical infrastructure and leverage its natural resources to shape favorable foreign policy outcomes, Canada’s federal government has a range of economic tools and the ability to design new ones when appropriate. Canada’s economic statecraft tool kit is similar to those of the United States and the European Union and includes sanctions, export controls, tariffs, and investment screening. Canada has imposed financial sanctions and export controls against Russia along with its Group of Seven (G7) allies. It has levied tariffs on Chinese electric vehicles, in line with US policy, and recently created investment screening authorities to address concerns about adversarial capital.

Financial sanctions

Similar to the United States, Canada maintains sanctions programs covering specific countries such as Russia and Iran, as well as thematic sanctions regimes such as terrorism. Global Affairs Canada (GAC), which is Canada’s Ministry of Foreign Affairs, administers sanctions and maintains the Consolidated Canadian Autonomous Sanctions List. Canada’s Finance Ministry, the Department of Finance, is not involved in sanctions designations, implementation, or enforcement, unlike in the United States, where the Department of the Treasury is the primary administrator of sanctions.

The Parliament of Canada has enacted legislation authorizing the imposition of sanctions through three acts: the United Nations Act; the Special Economic Measures Act (SEMA); and the Justice for Victims of Corrupt Foreign Officials Act (JVCFOA).

The United Nations Act enables GAC to implement sanctions against entities or individuals sanctioned by the UN Security Council. When an act of aggression or a grave breach of international peace occurs and the UN Security Council is unable to pass a resolution, Canada implements autonomous sanctions under SEMA; this act is Canada’s primary law for imposing autonomous sanctions and includes country-based sanctions programs. It is also used to align Canada’s sanctions with those of allies. For example, GAC derived its powers from SEMA to designate Russian entities and individuals in alignment with Canada’s Western allies in 2022. Meanwhile, the JVCFOA allows GAC to impose sanctions against individuals responsible for human rights violations and significant acts of corruption, similar to the Global Magnitsky Human Rights Accountability Act in the United States, with sanctions administered by the Office of Foreign Assets Control.

Once GAC adds entities and individuals to the lists of sanctions, Canadian financial institutions comply by freezing the designated party’s assets and suspending transactions. GAC coordinates with several government agencies to enforce and enable private-sector compliance with sanctions:

- FINTRAC: Canada’s financial intelligence unit (FIU)—Financial Transactions and Reports Analysis Centre of Canada (FINTRAC)—is responsible for monitoring suspicious financial activities and collecting reporting from financial institutions on transactions that may be linked to sanctions evasion. FINTRAC is an independent agency that reports to the Minister of Finance. FINTRAC works closely with the US financial intelligence unit—Financial Crimes Enforcement Network (FinCEN)—on illicit finance investigations and when sanctions evasion includes the US financial system. For example, FinCEN and FINTRAC both monitor and share financial information related to Russian sanctions evasion and publish advisories and red flags for the financial sector in coordination with other like-minded partner FIUs.

- OSFI: The Office of the Superintendent of Financial Institutions (OSFI) is a banking regulator that issues directives to financial institutions regarding compliance and instructs banks to freeze assets belonging to sanctioned individuals and entities. FINTRAC also shares financial intelligence with OSFI on sanctions evasion activity under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). OSFI shares intelligence with Royal Canadian Mounted Police (RCMP), the national police service of Canada, if there is evidence of sanctions evasion or other financial crimes.

- RCMP: Once OSFI notifies RCMP about suspicious activity, RCMP investigates whether the funds are linked to sanctions evasion or other financial crimes. If it finds evidence of a violation of sanctions or criminal activity, RCMP obtains a court order to seize assets under the Criminal Code and the PCMLTFA.

- CBSA: Canada Border Services Agency (CBSA) is responsible for blocking sanctioned individuals from entering Canada. CBSA also notifies OSFI if sanctioned individuals attempt to move cash or gold through border crossings.

All four agencies work with GAC and with one another on sanctions enforcement. GAC sets sanctions policy, FINTRAC analyzes financial intelligence and shares suspicious activity reports to inform law enforcement investigations, OSFI enforces compliance in banks, RCMP investigates crimes and seizes assets, and CBSA prevents sanctioned individuals from entering Canada and moving assets across borders.

While financial sanctions are part of Canada’s economic statecraft tool kit, Canadian sanctions power does not have the same reach as US sanctions. The preeminence of the US dollar and the omnipresence of major US banks allows the United States to effectively cut off sanctioned individuals and entities from the global financial system. Canadian sanctions are limited to Canadian jurisdiction and affect individuals and entities with financial ties to Canada, but they do not have the same reach as US financial sanctions.

Nevertheless, Canadian authorities have been able to leverage financial sanctions to support the G7 allies in sanctioning Russia. For example, in December 2022, under SEMA, Canadian authorities ordered Citco Bank Canada, a subsidiary of a global hedge fund headquartered in the Cayman Islands, to freeze $26 million owned directly or indirectly by Russian billionaire Roman Abramovich, who has been sanctioned by Canada and other G7 allies. In June 2023, Canadian authorities seized a Russian cargo jet at Toronto’s Pearson Airport pursuant to SEMA.

Figure 4

Export controls

Canada participates in several multilateral export control regimes, including the Wassenaar Arrangement, Nuclear Suppliers Group, Missile Technology Control Regime, and Australia Group. When multilateral regimes fall short in addressing Canada’s foreign policy needs, Canada leverages its autonomous export control list, which is administered by GAC under the Export and Import Permits Act. The Trade Controls Bureau under GAC is responsible for issuing permits and certificates for the items included on the Export Control List (ECL).

Canada Border Services Agency plays a crucial role in the enforcement of export controls. CBSA verifies that shipments match the export permit issued by GAC. It can seize or refuse exports that violate GAC export permits through ports, airports, and land borders. CBSA refers cases to the Royal Canada Mounted Police (CRMP) for prosecution if exporters attempt to bypass regulations.

Separately, FINTRAC monitors financial transactions that might be connected to the exports of controlled goods and technologies. If FINTRAC detects suspicious transactions, it shares intelligence with GAC and other relevant authorities. Canada’s method of leveraging financial intelligence for enforcing export controls is similar to that of the United States, where FinCEN has teamed up with the Commerce Department’s Bureau of Industry and Security to detect export control evasion through financial transactions.

While in the United States the export controls authority lies within the Commerce Department, Canada’s equivalent, Innovation, Science and Economic Development Canada (ISED), does not participate in administering export controls. That responsibility is fully absorbed by GAC.

While Canada has mainly used its export control authority in the context of sensitive technologies, Canadian politiciansand experts have recently been calling on the federal government to impose restrictions on mineral exports to the United States in response to US tariffs. The United States highly depends on Canada’s minerals, including uranium, aluminum, and nickel. Canada was the United States’ top supplier of metals and minerals in 2023 ($46.97 billion in US imports), followed by China ($28.32 billion) and Mexico ($28.18 billion). Notably, President Trump’s recent executive order called Unleashing American Energy instructed the director of the US Geological Survey to add uranium to the critical minerals list. Canada provides 25 percent of uranium to the United States. If Canada were to impose export controls on uranium, the US objective of building a resilient enriched uranium supply chain would be jeopardized.

However, Canada could not impose export controls on the United States without experiencing significant blowback. Export control is a powerful tool. While US tariffs would increase the price of imported Canadian goods by at least 25 percent, Canada’s export controls would completely cut off the flow of certain Canadian goods to the United States. It would be destructive for both economies, so Canada will likely reserve this tool as a last resort and perhaps work on finding alternative export destinations before pulling such a trigger.

Canada employs restrictive economic measures against Russia

In response to Russia’s unjust invasion of Ukraine in 2022, Canada imposed financial sanctions and export controls against Russia in coordination with G7 allies. To date, Global Affairs Canada has added more than 3,000 entities and individuals to its Russia and Belarus sanctions lists under SEMA. Assets of designated individuals have been frozen and Canadian persons are prohibited from dealing with them. Apart from financial sanctions, Canada imposed export controls on technology and import restrictions on Russian oil and gold. Canada also joined the G7 in capping the price of Russian crude oil at $60 per barrel and barred Russian vessels from using Canadian ports.

To enforce financial sanctions against Russia, FINTRAC joined the financial intelligence units (FIUs) of Australia, France, Germany, Italy, Japan, the Netherlands, New Zealand, the United Kingdom, and the United States to create an FIU Working Group with the mission of enhancing intelligence sharing on sanctions evasion by Russian entities and individuals. Separately, Canada Border Services Agency’s export controls enforcement efforts included the review of more than 1,500 shipments bound to Russia (as of February 2024), resulting in six seizures and fourteen fines against exporters. CBSA continues to work closely with the Five Eyes intelligence alliance to share information about export control evasion.

To disrupt the operation of Russia’s shadow fleet, Canada proposed the creation of a task force to tackle the shadow fleet in March 2025. Such a task force could be useful in addressing the various environmental problems and enforcement challenges the shadow fleet has created for the sanctioning coalition. However, the United States vetoed Canada’s proposal.

Figure 5

Tariffs

Canada’s approach to tariffs is governed primarily by the Customs Act, which outlines the procedures for assessing and collecting tariffs on imported goods, as well as the Customs Tariff legislation that sets the duty rates for specific imports (generally based on the “Harmonized System,” an internationally standardized system for classifying traded products). The Canada Border Services Agency is responsible for administering these tariffs. Additionally, the Special Import Measures Act enables Canada to protect industries from harm caused by unfair trade practices like dumping or subsidizing of imported goods, with the Canadian International Trade Tribunal determining injury and the CBSA imposing necessary duties. The minister of finance, in consultation with the minister of foreign affairs, plays a key role in proposing tariff changes or retaliatory tariffs, ensuring Canada’s trade policies align with its broader economic and diplomatic objectives.

Canada has frequently aligned with its allies on tariff issues, as demonstrated in 2024 when, following the US and EU tariffs, it imposed a 100 percent tariff on Chinese electric vehicles to protect domestic industries. However, Canada has also been proactive in responding to US tariffs, employing a combination of diplomatic negotiations, retaliatory tariffs, and reliance on dispute resolution mechanisms such as the World Trade Organization and USMCA. In the past Canada was also quick to align itself with allies such as the EU and Mexico, seeking a coordinated international response, as was the case in 2018 when the United States imposed a broad tariff on steel and aluminum.

Similar to the United States, Canada offers remission allowances to help businesses adjust to tariffs by granting relief under specific circumstances, such as the inability to source goods from nontariffed countries or preexisting contractual obligations. The Department of Finance regularly seeks input from stakeholders before introducing new tariffs. In 2024, a thirty-day consultation was launched about possible tariffs on Chinese batteries, battery parts, semiconductors, critical minerals, metals, and solar panels, though it has yet to result in any new tariffs.

Canada’s primary weakness regarding tariffs is its lack of trade diversification. The United States accounts for half of Canada’s imports and 76 percent of its exports. This dependency severely limits Canada’s ability to impose tariffs on the United States without facing significant economic repercussions. Canada’s relatively limited economic leverage on the global stage also complicates efforts to coordinate multilateral tariff responses or to negotiate favorable trade agreements. Furthermore, Canada’s lengthy public consultations and regulatory processes for implementing tariffs hinder its ability to leverage tariffs as a swift response to changing geopolitical or economic circumstances.

Figure 6

Investment screening

Canada’s investment screening is governed by the Investment Canada Act (ICA), which ensures that foreign investments do not harm national security while promoting economic prosperity. The ICA includes net benefit reviews for large investments and national security reviews for any foreign investments which pose potential security risks, such as foreign control over critical sectors like technology or infrastructure.

The review process is administered by ISED, with the minister of innovation, science, and industry overseeing the reviews in consultation with Public Safety Canada. For national security concerns, multiple agencies assess potential risks, and the Governor-in-Council (GIC) has the authority to block investments or demand divestitures.

Criticism of the ICA includes lack of transparency and consistency, particularly in national security reviews, where decisions may be influenced by political or diplomatic considerations. To better mitigate risks to security, critical infrastructure, and the transfer of sensitive technologies, experts have argued that the ICA should more effectively target malicious foreign investments by incorporating into the review process the perspectives of Canadian companies on emerging national security threats. In response to these concerns, Bill C-34 introduced key updates in 2024, including preclosing filing requirements for sensitive sectors, the possibility of interim conditions during national security reviews, broader scope covering state-owned enterprises and asset sales, consideration for intellectual property and personal data protection, and increased penalties for noncompliance. In March 2025, further amendments were made to the ICA, expanding its scope to review “opportunistic or predatory” foreign investments. These changes were introduced in response to the United States’ imposition of blanket tariffs on Canadian goods.

Figure 7

Positive economic statecraft

Apart from coercive/protective tools, Canada maintains positive economic statecraft (PES) tools such as development assistance to build economic alliances beyond North America. For example, Canada is one of the largest providers of international development assistance to African countries. After Ukraine, Nigeria, Ethiopia, Tanzania, and the Democratic Republic of the Congo were the top recipients of Canada’s international assistance. Canada’s PES tools lay the ground for the federal governments to have productive cooperation when needs arise. Canadian authorities should leverage PES tools to enhance the country’s international standing and increase economic connectivity with other regions of the world. This is especially important amid the US pause on nearly all US foreign assistance. Canada could step up to help fill the vacuum in the developing world created by the Trump administration’s radical departure from a long-standing US role in foreign aid.

Canadian authorities have already taken steps in this direction. On March 9, Canadian Minister of International Development Ahmed Hussen announced that Canada would be providing $272.1 million for foreign aid projects in Bangladesh and the Indo-Pacific region. The projects will focus on climate adaptation, empowering women in the nursing sector, advancing decent work and inclusive education and training. Earlier, on March 6, Global Affairs Canada launched its first Global Africa Strategy with the goal of deepening trade and investment relations with Africa, partnering on peace and security challenges, and advancing shared priorities on the international stage including climate change. Through this partnership, Canada plans to strengthen economic and national security by enhancing supply chain resilience and maintaining corridors for critical goods.

Conclusion

Canada’s federal government maintains a range of economic statecraft tools and authorities to address economic and national security threats. While regional factionalism and provincial equities can hinder the federal government’s ability to leverage the full force of Canada’s economic power, threats to Canada’s economic security, including tariffs from the United States, may prove to further unite and align the provinces. The federal government and provincial premiers should work together to meet this challenging moment, consolidating Canada’s sources of economic power and moving forward with a cohesive economic statecraft strategy to protect the country’s national security and economic security interests.

Canada’s leadership and engagement in international fora including the G7, NATO, Wassenaar Agreement, among others, as well as its bilateral relationships, make it well-placed to coordinate and collaborate with Western partners on economic statecraft. Information sharing, joint investigations, multilateral sanctions, and multilateral development and investment can extend the reach of Canada’s economic power while strengthening Western efforts to leverage economic statecraft to advance global security objectives and ensure the integrity of the global financial system. Canada also has a solid foundation for building economic partnerships beyond the West through development assistance and other positive economic statecraft tools.

About the authors

The authors would like to thank Nazima Tursun, a young global professional at the Atlantic Council’s Economic Statecraft Initiative, for research support.

The report is part of a year-long series on economic statecraft across the G7 and China supported in part by a grant from MITRE.

Related content

Explore the program

Housed within the GeoEconomics Center, the Economic Statecraft Initiative (ESI) publishes leading-edge research and analysis on sanctions and the use of economic power to achieve foreign policy objectives and protect national security interests.

Image: The Canada flag waves in front of Parliament Hill in Ottawa. iStock